February 2013

Constitutionality Question Looms as USPTO Implements Regime that favors a “Filers” over “Inventors”

Madstad Engineering, Inc. v. U.S. Patent & Trademark Office, 8:12-cv-01589 (M.D. Fla. 2013)

In 2012, Madstad filed a declaratory judgment action against the USPTO and requesting that the court find various aspects of the America Invents Act to be unconstitutional. Madstad's basic argument is that when the U.S. Constitution speaks of exclusive rights for "inventors" it should be interpreted to mean "first and true inventor." Under this analysis, the AIA fails because it purposefully rewards the first-to-file a patent application rather than the first-to-invent. The complaint argues:

A second 'inventor' is an oxymoron; that person merely rediscovers that which was already discovered by the first inventor. Thomas Jefferson, James Madison, and John Marshall all shared this understanding. . . . Congress is not authorized to award patents to the winners of races to file to the PTO. . . . Under the AIA, there is no effective statutory requirement that the applicant be an 'inventor' for a patent to be valid.

Madstad has also requested a preliminary injunction blocking implementation of the first-to-file provisions of the Act.

As we approach the March 16, 2013 implementation date, we can look for the plaintiffs to push the court again for a decision on its motion for preliminary injunction or perhaps a temporary restraining order (TRO) that would block implementation. Madstad is represented by Jonathan Massey.

FM v. Google: Means-plus-Function Indefiniteness and O2 Micro Challenges

By Jason Rantanen

Function Media, L.L.C. v. Google Inc. (Fed. Cir. 2013) Download FM v Google

Panel: Rader, Newman, Reyna (author)

Function Media sued Google for infringement of three related patents: 6,446,045; 7,240,025; and 7,249,059. The patents involve a system for facilitating advertising on multiple advertising outlets (such as different websites) with different formatting requirements. The district court granted summary judgment that the sole independent claim of the '045 patent was indefinite and a jury subsequently found that the asserted claims of the '025 and '059 patents invalid and not infringed. The district court granted JMOL of validity of four claims but the noninfringement verdict stood. FM appealed several issues including the indefiniteness ruling and raised a challenge based on O2 Micro.

Indefiniteness: Claim 1 of the '045 patent reads as follows:

1. A method of using a network of computers to contract for, facilitate and control the creating and publishing of presentations, by a seller, to a plurality of media venues owned or controlled by other than the seller, comprising:

a) providing a media database having a list of available media venues;

b) providing means for applying corresponding guidelines of the media venues;

c) providing means for transmitting said presentations to a selected media venue of the media venues;

d) providing means for a seller to select the media venues; and

e) providing means for the seller to input information;

whereby the seller may select one or more of the media venues, create a presentation that complies with said guidelines of the media venues selected, and transmit the presentation to the selected media venues for publication.

At issue was the italicized "means for transmitting" claim element, which the district court held to be indefinite because the specification did not disclose a structure for carrying out the claimed function, as required by 35 U.S.C. § 112(f) [previously referred to as 112[6]).

On appeal, the Federal Circuit affirmed the district court's ruling, emphasizing the requirement that an algorithm must be disclosed when using a means-plus-function claim involving software. "When dealing with a “special purpose computer-implemented means-plus-function limitation,” we require the specification to disclose the algorithm for performing the function." Slip Op. at 9. For this claim element, at least, no algorithm was disclosed: "Here, there is no specific algorithm disclosed in prose, as a mathematical formula, in flow charts, or otherwise. FM cites to several places in the specification that it contends describe the software. These citations all explain that the software automatically transmits, but they contain no explanation of how the [Presentation Generating Program] software performs the transmission function." Id. at 10. "At most, the ’045 Patent specification discloses that the structure

behind the function of transmitting is a computer program that transmits. Beyond the program’s function, however, no algorithm is disclosed. As in Blackboard, the PGP is “simply an abstraction that describes the function” to be performed. 574 F.3d at 1383." Id.

Nor could FM rely on the knowledge of a PHOSITA: "Having failed to provide any disclosure of the structure for the “transmitting” function, FM cannot rely on the knowledge of one skilled in the art to fill in the gaps." Id. at 11. It was irrelevant that a person of ordinary skill could devise some method to perform the function: that goes to enablement, not to definiteness.

Comment: Ironically here, it was probably the use of the narrowing "means" language that ultimately resulted in the holding of indefiniteness. If the patentee had instead just referenced "a computer controller transmitting said presentation" (similar to what it did in Claim 1 of the '025 patent), it almost certainly would have survived an indefiniteness challenge. See Mark A. Lemley, Software Patents and the Return of Functional Claiming (forthcoming in Wisconsin Law Review) at 41-42 (arguing that the Federal Circuit imposes no limit on the functional nature of software claim elements unless they use "means," thus negating the compromise established by 112(f)).

O2 Micro: In addition to challenging several of the district court's claim constructions (which the CAFC affirmed), FM argued that the court improperly sent issues of claim construction to the jury in contravention of O2 Micro v. Beyond Innovation, 521 F.3d 1351 (Fed. Cir. 2008). The Federal Circuit rejected FM's arguments, limiting O2 Micro to the rare circumstance when arguments about different claim scopes are actually presented to the jury. "We disagree with FM that claim construction was decided by the jury because the district court’s construction was correct, and the district court never refused to construe any disputed terms. Moreover, as with the other terms, FM never objected to any supposed improper argument or testimony." Slip Op. at 26. Absent this situation, the issue was whether Google made improper arguments to the jury, an issue on which FM bore an extremely high burden that it could not carry.

Final Rules on First-to-File Regime

By Dennis Crouch

On February 14, 2013, the USPTO published its final rules to govern implementation of the first-to-file provisions of the Leahy-Smith America Invents Act. The new rules will apply to any application claiming with an effective filing date of on or after March 16, 2013. The USPTO has simultaneously released its Examination Guidelines for Implementing the First Inventor To File Provisions of the Leahy-Smith America Invents Act. These documents run 160 and 120 pages respectively.

Read them while they're hot:

Valentines Wishes

Of Smart Phone Wars and Software Patents

By Dennis Crouch

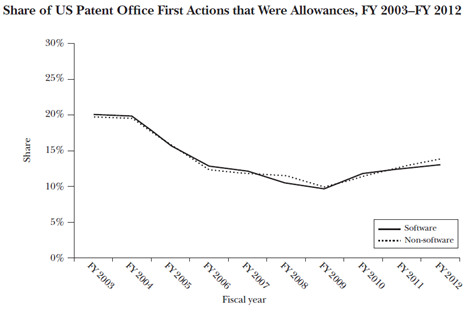

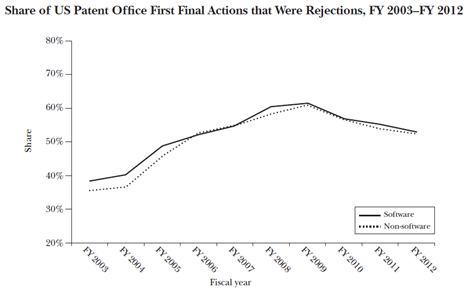

Stuart Graham (USPTO’s Chief Economist) and Saurabh Vishnubhakat recently published an interesting short paper entitled Of Smart Phone Wars and Software Patents. The paper largely defends the USPTO’s examination of software patenting by showing that its approach in the software arts is essentially the same as in other fields.

The two charts below come from the article. The first shows the percentage of first office actions that are first-action allowances. This is calculated for each fiscal year as the (# of first action allowances) / (# of first actions). The second chart looks at the first “final” action in a case. For their study, a final action is either (1) a final rejection or (2) an allowance. And, the first final is whichever one of those came first.

The point of the article was to show that software patents have been treated approximately the same as other patent applications. That is an important take-away. However, what is amazing to me is the dramatic change in practice that we have seen over the past few years.

Selling Patents

by Dennis Crouch

The folks at IP Offerings have released a summary of publicly available US patent sales from 2012. The 35 transactions on the list included 6,985 patents assigned at a total value of $2.9 billion. The average price per patent was $422 thousand with a median of $221 thousand. IP Offerings also reports that the average transaction price is $374 thousand per patent.

It is nice to have these numbers, but the reality is that the vast majority of patent sales (and licenses) are done out of the public eye and without distributing any public information regarding price or terms. It is hard to know whether these numbers are typical.

ht: IP Watch

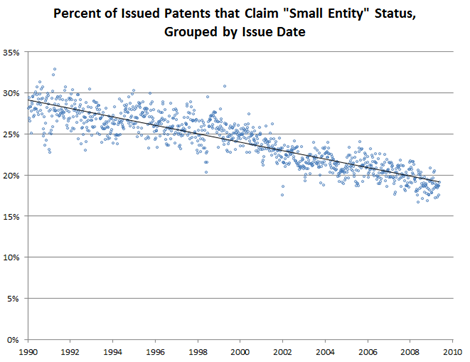

Small Entity Status

An applicant can claim small entity status if:

- If the owner is a “person” (i.e. individual or individuals) who has not assigned, granted, conveyed, or licensed, and is under no obligation under contract or law to assign, grant, convey, or license, any rights in the invention.

- If the owner is a “small business concern.” Under the SBA regulations, this means that the owner, including affiliates, has fewer than 500 employees and the owner has not assigned, granted, conveyed, or licensed, and is under no obligation under contract or law to assign, grant, convey, or license, any rights in the invention.

- A non-profit organization (regardless of size), including institutions of higher education who has not assigned, granted, conveyed, or licensed, and is under no obligation under contract or law to assign, grant, convey, or license, any rights in the invention.

- If the owner has transferred or licensed rights, or is under obligation to do so, it can still qualify for small entity status so long as each party individually meets the requirements listed here.

It will be interesting to see how this chart develops with the new “micro entity status” being implemented next month.

Does the Presumption of Validity Apply to Section 101 Subject-Matter-Eligibility Questions?

By Dennis Crouch

One issue put before the en banc Federal Circuit in CLS Bank v. Alice is whether the presumption of validity applies to subject matter eligibility questions. The statute, 35 U.S.C. § 282 indicates that "A patent shall be presumed valid" and in Microsoft Corp. v. i4i Ltd. Partnership, 564 U.S. (2011), the Supreme Court confirmed that presumption can only be overcome with clear and convincing evidence of invalidity. However, in cases like Mayo and Bilski the Supreme Court has not provided even one suggestion supporting the notion that subject matter eligibility challenges are treated with such a presumption.

There are a few reasons to think that the strong presumption of validity does not apply to subject matter eligibility questions.

Subject matter eligibility is a question of law and is normally based on very few factual determinations. It is that setup that allowed the district court to rule on CLS Bank's Section 101 so early in the present case. As Justice Breyer wrote in his i4i concurring opinion, "evidentiary standards of proof apply to questions of fact and not to questions of law." Under Justice Breyer's construct, any facts that serve as a basis for an eligibility challenge would need to be justified with clear and convincing evidence, but with questions of law we demand that the judge apply the correct legal standard and do away with any other evidentiary burden. The particular facts in this case further weigh against the a strong presumption of validity in this case because the patent prosecution history file show that the PTO applied a less rigorous patent eligibility test than that required by Bilski and Mayo.

In its reply brief, CLS Bank picks up on Professor Hricik's 2012 essay where he questioned whether courts are correct in their assumption that a patent issued on non-patentable subject matter is invalid and my follow-on essay questioning whether a third party can challenge subject matter eligibility in the new Post-Grant Review procedure. Both essays looked at the defenses identified by 35 U.S.C. § 282 and argued that Section 101 may well fall outside the scope of those statutory defenses. At first blush, our arguments appear to favor the patentee by saying that an issued patent cannot be challenged on Section 101 grounds. However, CLS Bank provides an interesting twist that begins with the understanding that we know from Mayo that issued patents can definitely be challenged under Section 101. In its brief, CLS Bank reconciles these competing factors with the suggestion that the 101 challenge is an eligibility challenge rather than a validity challenge.

CLS Bank writes:

More generally, the presumption of validity does not apply to patent eligibility challenges. The Supreme Court did not even mention the presumption in Mayo, Bilski, Diehr, Flook, or Benson. That makes sense because what Congress named the "[p]resumption of validity" applies only to the statutory bases for invalidating a patent. As the Supreme Court has explained, Section 101 is a "threshold test." Bilski. It defines subject-matter eligibility for patenting and is judicially enforceable before any bases for invalidity are ever reached. Mayo.

The Supreme Court's consistent practice finds support in the text of the Patent Act. The Act applies the presumption explicitly to Section 102, 103, 112, and 251, and "[a]ny other fact or act made a defense by [the Act]." 35 U.S.C. § 282. Section 101 is conspicuously missing. Nor is Section 101 a "fact or act made a defense by [the Act]," because its drafting reflects that it is an eligibility "threshold." See Bilski.

This second argument is perhaps too clever by half – especially when you read the penultimate sentence of Mayo where the court writes that "[t]he claims are consequently invalid." In this most recent pronouncement, the Supreme Court appears to believe that the eligibility question is indeed a validity question. Assuming Mayo forecloses the eligibility-not-validity argument, CLS Bank is left in the uncomfortable position of simply arguing that eligibility questions do not qualify as a proper defense.

Upcoming Oral Arguments in Myriad

Association for Molecular Pathology v. Myriad Genetics, Inc. (SCOTUS 2013)

The Supreme Court has now set oral arguments for April 15, 2013. The petition for certiorari posed the following questions:

Many patients seek genetic testing to see if they have mutations in their genes that are associated with a significantly increased risk of breast or ovarian cancer. Respondent Myriad Genetics obtained patents on two human genes that correlate to this risk, known as BRCA1 and BRCA2. These patents claim every naturally-occurring version of those genes, including mutations, on the theory that Myriad invented something patent-eligible simply by removing ("isolating") the genes from the body. Petitioners are primarily medical professionals who regularly use routine, conventional genetic testing methods to examine genes, but are prohibited from examining the human genes that Myriad claims to own. This case therefore presents the following questions:

1. Are human genes patentable?

2. Did the court of appeals err in upholding a method claim by Myriad that is irreconcilable with this Court's ruling in Mayo Collaborative Servs. v. Prometheus Labs., Inc., 132 S. Ct. 1289 (2012)?

3. Did the court of appeals err in adopting a new and inflexible rule, contrary to normal standing rules and this Court's decision in MedImmune, Inc. v. Genentech, Inc., 549 U.S. 118 (2007), that petitioners who have been indisputably deterred by Myriad's "active enforcement" of its patent rights nonetheless lack standing to challenge those patents absent evidence that they have been personally threatened with an infringement action?

And, the Supreme Court granted certiorari as to only question number 1. Although not announced yet, I expect that the US Government will participate in oral arguments along with the parties.

http://www.supremecourt.gov/Search.aspx?FileName=/docketfiles/12-398.htm

No Federal Cause of Action against Inventor’s Attempt to Derrogate Patent in Violation of Assignor Estoppel Doctrine

By Dennis Crouch

Semiconductor Energy Labs v. Nagata (Fed. Cir. 2013)

SEL is a Japanese “research company” owned by mega-inventor Shunpei Yamazaki who is named as inventor of more than 750 U.S. patents. Dr. Nagata is a co-inventor on SEL’s U.S. Patent No. 6,900,463. When SEL sued Samsung for infringing the ‘463 patent the company learned that Samsung had hired Nagata. In that litigation Nagata testified on behalf of Samsung that his signature on the assignment and declaration was forged. The parties eventually settled that lawsuit, but SEL later argued that the settlement value was substantially decreased by Nagata’s testimony.

SEL then sued Dr. Nagata in the N.D. California federal court alleging several state law causes of action (breach of contract, slander, quiet title) as well as “violation of federal patent law.” The patent law claim was premised on the patent common law doctrine of assignor estoppel that, in certain circumstances, prevents an assignor from later challenging the validity of an assigned patent in court. In Diamond Scientific Co. v. Ambico, Inc., 848 F.2d 1220 (Fed. Cir. 1988), the court wrote that the doctrine “embodies fundamental principles of federal patent law and policy” and imposes a “duty of fair dealing . . . on an inventor who assigns intellectual property rights that are protected by the Constitution.”

The district court dismissed the lawsuit against Nagata – finding that no federal cause of action is created by violation of the assignor estoppel doctrine and then declining to exercise supplementary jurisdiction over the state law claims.

On appeal, the Federal Circuit has affirmed – holding that assignor estoppel is an equitable shield that cannot be wielded as the basis for a declaratory judgment action.

[W]e are not inclined to transform the shield into a sword. The relief requested by SEL is akin to seeking a declaratory judgment of patent validity, which is not a viable cause of action. As the district court fittingly noted, “it simply makes no sense to use a doctrine intended to estop a party from advancing a particular claim or defense in a legal case as a way to sue a non-party who has made no claim or defense in a legal case.”

The conclusion here is that the only federal remedy available for SEL is to block certain testimony at trial. And, even then, assignor estoppel may well fail to block testimony. The court writes:

Moreover, we have routinely rejected the proposition that assignors should be prohibited from testifying as fact witnesses in cases where they are neither a party to a case nor in privity with the defendant, and we will not now devise a cause of action to preclude such testimony. See, e.g., Verizon Servs. Corp. v. Cox Fibernet Va., Inc., 602 F.3d 1325, 1339–40 (Fed. Cir. 2010) (holding no error by district court in allowing inventors to testify about patents they invented and declining to address argument that assignor estoppel barred such testimony); Checkpoint Sys., 412 F.3d at 1337 (rejecting argument that non-party assignor should be barred from submitting testimony regarding failure to name inventors under doctrine of assignor estoppel).

SEL argued in the alternative that its state law claims also raise substantial federal patent issues and thus “arise under” the patent laws. In Christianson v. Colt Indus. Operating Corp., 486 U.S. 800 (1988), the Supreme Court indicated that state law claims can create a federal law cause of action if “plaintiff’s right to relief necessarily depends on resolution of a substantial question of federal patent law, in that patent law is a necessary element of one of the well-pleaded claims.” Although not directed at patent law, the Supreme Court muted Christianson’s power in Grable & Sons Metal Prods., Inc. v. Darue Eng’g & Mfg., 545 U.S. 308, 312 (2005) by requiring a consideration of state interest in resolving the dispute. Here, SEL suggests that its state law causes of action all stem from violation of the federal common law doctrine of assignor estoppel – thus creating a substantial question of patent law. The appellate court rejected that notion – holding instead that “the asserted federal issue was insubstantial, implausible, and without merit.”

Dismissal affirmed.

This case would likely have been a Rule 36 affirmance without opinion but for the fact that the US Supreme Court is currently considering the case of Gunn v. Minton. That case focuses on whether a state law attorney malpractice case raises a Federal Cause of Action under 28 U.S.C. 1338(b). In Gunn, the Texas Supreme court dismissed the case for lack of subject matter jurisdiction – holding that Section 1338 preempted its usual power of general jurisdiction. See Minton v. Gunn, 55 Tex. Sup. Ct. J. 196 (2011).

The decision here along with DeRosa v. J.P. Walsh & J.L. Marmo Enterprises (Marmo) (Fed. Cir. 2013) (no jurisdiction over contract dispute) are likely intended as signals to the Supreme Court that the Federal Circuit is acting responsibly and carefully in this field.

Patent Marketplace

by Dennis Crouch

- GOLD CHARM LIMITED has obtained assignment of rights from various FOXCONN PRECISION companies. In its filings, GOLD CHARM claims to be located in Samoa. I suspect that this is merely a holding company still wholly owned by FOXCONN.

- RPX CORPORATION received patents from several sellers, including GRAPHICS PROPERTIES HOLDINGS, INC., PANASONIC, BACKWEB TECH., CRAIG POULTON, and INVRO.

- IBM assigned a couple of hundred patents to MENTOR GRAPHICS, CITRIX SYSTEMS, HUAWEI, and SEMICONDUCTOR MFG INT’L.

- INSELBERG INTERACTIVE LLC has assigned the rest of its patents to Mr. FRANK BISIGNANO who appears to be different than the Frank J. Bisignano who runs JP Morgan. Some of the patents have already been asserted – such as seat-tweeting. The inventor Eric Inselberg may be awaiting trial for selling fraudulent sports memorabilia.

- WEST CORPORATION transferred many of its patents to the patent licensing entity, TUXIS TECHNOLOGIES LLC. Many of these patents were co-invented by Ronald A. Katz.

- GOOGLE INC. purchased a few patents, including three from SEMICONDUCTOR COMPONENTS INDUSTRIES; two each of from GREENLIANT LLC, CASCADES VENTURES, and SMARTPENNY.COM; and one from INTELLECTUAL DISCOVERY CO., LTD.

- AT&T has assigned sets of patents to three newly formed Delaware limited liability corporations: SAWAHOSHI CAPITAL LLC; CHANYU HOLDINGS, LLC; and LITTLEMORE TECHNOLOGIES LLC. These look like more privateers.

CLS Bank v. Alice Corp: Oral Arguments Lead to More Questions

By Dennis Crouch

CLS Bank v. Alice Corp (Fed. Cir. 2013)

On February 8, 2013, the Federal Circuit held oral arguments en banc in this important subject matter eligibility dispute that focuses on the extent that software can be patented. Under Federal Circuit rules, en banc rehearings include all of the regular circuit court judges as well as any other judge who sat on the original panel. For this case, the nine regular members of the court were joined by Senior Judge Richard Linn who sat on the original panel and penned the opinion of the court that has offended so many anti-software-patent advocates. In the opinion, Judge Linn cabined-in the definition of “abstract” with regard to computer implemented inventions and also indicated that §101 should only be used to invalidate a claim when that result is “manifestly evident.” [UPDATED] With a ten-member panel the accused infringer (CLS Bank) needs six votes to overturn the original panel decision. With a ten member panel, six votes are needed to win. Since the original appellate decision was vacated, this appeal comes directly from the district court. As such, a five-five tie will affirm the lower court holding of invalidity. While I suspect that Linn’s language putting Section 101 on the back burner will not survive, I suspect that at least some claims will be seen to pass muster under Section 101.

The parties are in relative agreement on many points. None of the parties seriously argue that software per se is patentable – apparently assuming that software apart from its computer implementation always embodies an abstract idea. All of the parties also agreed that a computer specially designed to perform a particular function can also be patentable. The dispute centers on what test should be used to determine when you have such a “specialized computer” and on whether Alice Corp’s claimed invention meets that standard.

Most notably absent from the oral arguments was any discussion of the meaning of an “abstract idea.” Of course it is the ambiguity in the definition of abstract idea that is causing most of the confusion regarding subject matter eligibility.

For decades, patent attorneys have known that software can be patentable if properly claimed in a way that directs attention away from the software nature of the invention. I suspect that the rule-of-thumb for patent eligibility will focus on complexity of the relationship between software and hardware. And, if that is the case patent attorneys will renew their reputation for taking simple ideas and making them appear quite complex.

Mark Perry represented the accused infringer (CLS Bank) and argued that one starting point for subject matter eligibility is the notion that a process accomplished “entirely in the human mind or made with pen and paper” cannot be patent eligible. Further, merely speeding-up that process by using a computer does not somehow transform the process into a patentable invention – “it simply accelerates the process.” The bulk of the questioning focused whether CLS had overgeneralized the claims. For instance, when Mr. Perry began reading from the patent’s invention summary he was stopped by Judge Linn who responded that every claim can be distilled to an abstract summary but “that’s not the way that we assess patent eligibility or patentability.”

Judge Moore focused the questioning on the CLS Bank claim that included the most physical structure. Claim 26 of the ‘375 patent reads as follows:

26. A data processing system to enable the exchange of an obligation between parties, the system comprising:

a communications controller,

a first party device, coupled to said communications controller,

a data storage unit having stored therein

(a) information about a first account for a first party, independent from a second account maintained by a first exchange institution, and

(b) information about a third account for a second party, independent from a fourth account maintained by a second exchange institution; and

a computer, coupled to said data storage unit and said communications controller, that is configured to

(a) receive a transaction from said first party device via said communications controller;

(b) electronically adjust said first account and said third account in order to effect an exchange obligation arising from said transaction between said first party and said second party after ensuring that said first party and/or said second party have adequate value in said first account and/or said third account, respectively; and

(c) generate an instruction to said first exchange institution and/or said second exchange institution to adjust said second account and/or said fourth account in accordance with the adjustment of said first account and/or said third account, wherein said instruction being an irrevocable, time invariant obligation placed on said first exchange institution and/or said second exchange institution.

Judge Moore rightly suggested that a computer by itself is clearly a machine and subject-matter eligible. She queried then, how can a more particular invention – the computer with particular functionality – be ineligible? Perry offered two responses. First, he argued that the claim here is really method claim masquerading as a machine claim – that method itself is an abstract idea and the addition of the computer hardware does not make the claims eligible. Further, Perry argued that the claims here are not directed to any particular computer but instead a generic system. Judges Moore and Newman then queried whether the real focus should be on obviousness. Perry admitted that the claims may also be invalid under Section 103, but that the Supreme Court has indicated that Section 101 is a threshold inquiry. In addition, he argued, Section 101 inquiries are often easy because they do not require substantial discovery.

Perry also suggested that the requirement for extensive particular hardware rightly favors companies like CLS Bank and Google who spend millions of dollars to build systems that actually work rather than companies like Alice who merely develop a “McKinsey Report” and file for patent protection.

With Ray Chen on the sideline pending confirmation of his Federal Circuit judicial nomination, Deputy Solicitor Nathan Kelley stepped up and primarily sided with CLS Bank – arguing that software per se cannot be patent eligible because it is an abstract idea and that merely connecting software to a computer is likewise patent ineligible. The oddball test suggested by the PTO borrows the separability concept from copyright law. In copyright, a useful article is only copyrightable if the original expression is at least conceptually separable from the utility of the article. The PTO argues that an inseparability requirement should be put in place for computer implemented inventions. Under that construct, a computer implemented invention that applies an abstract idea would only be patent eligible if the computer is inseparably and inextricably linked to the invention. In oral arguments, Kelley suggested that the approach requires the “fact finder” to “go deeper” in considering whether an inextricable link exists. Mr. Kelly did agree (on questioning from Judge Moore) that the focus in this process should be on the language of the claims.

What the PTO wants out of this is a practical test that its examiners can follow rather than just the notion of an “abstract idea.” I believe that the agency would have been better served if he had focused on that point rather introducing a new concept into the law that does little or nothing to resolve ambiguity.

Adam Perlman argued for the patentee (Alice Corp) and likewise did not defend software patents. Rather, Perlman argued that his client’s patents were technology-focused inventions that wove together software and hardware in a way that “creates a new machine” that clearly satisfies the requirements of Section 101.

There was some back and forth about preemption. Neither party mentioned this, but a point relevant to preemption is likely CLS’s allegations at the district court level that it did not infringe the patents.

The Federal Circuit will likely take a few months to decide this appeal. An important issue will be to see whether the court decides this case quickly or waits for the Supreme Court to release its decision in Myriad. Although not computer implemented, the outcome of Myriad case could impact the law here.

President Obama Nominates Two to Serve on the US Court of Appeals for the Federal Circuit

The following is the press release:

WASHINGTON, DC – Today, President Obama nominated Raymond T. Chen and Todd M. Hughes to the United States Court of Appeals for the Federal Circuit.

“ Raymond T. Chen and Todd M. Hughes have displayed exceptional dedication to public service throughout their careers,” President Obama said. “I am honored to nominate them today to serve the American people on the United States Court of Appeals. I am confident that they will be judicious and esteemed additions to the Federal Circuit.”

Raymond T. Chen: Nominee for the United States Court of Appeals for the Federal Circuit

Raymond T. Chen currently serves as the Deputy General Counsel for Intellectual Property Law and Solicitor for the United States Patent and Trademark Office (USPTO), a position he has held since 2008.

Chen received his B.S. in electrical engineering in 1990 from the University of California, Los Angeles, and his J.D. in 1994 from the New York University School of Law. After graduating from law school, he joined Knobbe, Martens, Olson & Bear, a boutique intellectual property law firm in Irvine, California, where he prosecuted patents and represented clients in intellectual property litigation. From 1996 to 1998, Chen served as a Technical Assistant at the United States Court of Appeals for the Federal Circuit, performing the functions of a staff attorney. At the end of his two-year term, he joined the USPTO as Associate Solicitor and remained in that role until his promotion to Solicitor in 2008. Since joining the USPTO, Chen has represented the agency in numerous appeals before the Federal Circuit and personally argued over 20 cases, issued guidance to patent examiners to ensure consistency with developing law, advised the agency on legal and policy issues, and helped promulgate regulations. He has co-chaired the Patent and Trademark Office Committee of the Federal Circuit Bar Association and is a member of the Advisory Council for the United States Court of Appeals for the Federal Circuit.

Todd M. Hughes: Nominee for the United States Court of Appeals for the Federal Circuit

Todd M. Hughes is Deputy Director of the Commercial Litigation Branch of the Civil Division at the United States Department of Justice, a position he has held since 2007. He also has served as an adjunct lecturer in law with the Cleveland-Marshall College of Law and as an instructor for Duke University’s writing program.

Hughes received his A.B. from Harvard College in 1989 and completed a joint degree program with Duke University, earning both his J.D. with honors and his M.A. in English in 1992. After graduating from law school, Hughes clerked for the Honorable Robert B. Krupansky of the United States Court of Appeals for the Sixth Circuit. In 1994, he joined the Commercial Litigation Branch as a trial attorney. Five years later, he was appointed to be Assistant Director for Commercial Litigation, a role he held until assuming the title of Deputy Director in 2007. Throughout his career with the Department of Justice, Hughes’s practice has been devoted to matters of federal personnel law, veterans’ benefits, international trade, government contracts, and jurisdictional issues regarding the United States Court of Federal Claims. He has extensive experience before the United States Court of Appeals for the Federal Circuit, the United States Court of International Trade, and the United States Court of Federal Claims, and he has garnered a number of special commendations from the Department of Justice and a special contribution award from the Department of Veterans Affairs.

Federal Circuit Judicial Watch

By Dennis Crouch

Three of the Federal Circuit’s twelve judicial positions are currently open. Those slots were previously held by Judges Michel, Linn, and Bryson. Judge Michel’s slot has been unfilled since his 2010 retirement, but the nominee, Richard Taranto, appears to be finally moving forward. In a voice vote today, the Senate Judiciary committee approved Taranto’s nomination. See http://www.judiciary.senate.gov. The nomination must still be confirmed by the Senate as a whole. Judges Linn and Bryson vacated their positions in November 2012 and January 2013 respectively. President Obama has not yet offered any nominees to fill those slots, although I hear that they are in the works. (If you have not yet heard from the White House, then you are not getting nominated. Sorry.)

For more reading, look at the recent NLJ editorial by Professor Carl Tobias: Circuit court confirmations an imperative.

Next Step for Director Kappos:

by Dennis Crouch

Former USPTO Director David Kappos announced today that he has joined the New York corporate law firm of Cravath, Swaine & Moore LLP as a partner. The 500+ attorney firm only has two registered patent attorneys on staff and does not directly handle patent prosecution. However, the firm is intensely involved in complex corporate deals with major intellectual property components. The firm’s patent litigation department tends be called-on for cases that potentially have a substantial antitrust or regulatory component such as ANDA litigation and litigation associated with patents covering industry standards.

Arkema v. Honeywell: Declaratory Judgment Jurisdiction in the Indirect Infringement Context

by Jason Rantanen

Arkema v. Honeywell (Fed. Cir. 2013) Download 12-1308.Opinion.2-1-2013.1

Panel: Dyk (author), Plager, O'Malley

In 2009, Honeywell sued Arkema in Germany for infringement of the European patent. Arkema responded with a declaratory judgment action in the US over two related patents. Those suits are still ongoing. In late 2011, the ‘120 and ‘882 patents issued and Arkema moved to amend its declaratory judgment complaint to allege non-infringement and invalidity of those patents, premised on a concern that it would be indirectly liable for its future customers' use of 1234yf. The district court refused to allow the amendment because it concluded that the Constitutionally mandated “case or controversy” that undergirds court power did not exist as to those new claims.

In a Rule 54(b) certified appeal, the Federal Circuit reversed the district court's denial of Arkema's motion to supplement its complaint, noting that "On its face, this is a quintessential example of a situation in which declaratory relief is warranted." Slip Op. at 9. The opinion sets out several useful points for evaluating declaratory judgment jurisdiction in an indirect infringement context post-MedImmune.

No noninfringing uses: Both parties admitted that there are no known methods of using 1234yf in an automobile air conditioning system that do not at least arguably infringe its patents. Given this, "there can hardly be any question that Arkema would arguably be liable for induced infringement if it sells 1234yf for use in automobile air conditioning systems. Where, as here, there is no dispute that the

intended use would be at least arguably infringing and actively encouraged by the declaratory judgment plaintiff, a controversy is “sufficiently real” for the purposes of declaratory judgment jurisdiction." Slip Op. at 13. The court further noted that it is not necessary for a party to concede infringement to demonstrate a justiciable controversy.

En Banc Arguments This Week

by Dennis Crouch

On February 8, 2013 (this Friday), the Federal Circuit will sit en banc and hear arguments on two important patent cases. In CLS Bank v. Alice Corp the court will focus on the patenting of inventions implemented through software. The two particular questions highlighted in the en banc order are:

a. What test should the court adopt to determine whether a computer-implemented invention is a patent ineligible “abstract idea”; and when, if ever, does the presence of a computer in a claim lend patent eligibility to an otherwise patent-ineligible idea?; and

b. In assessing patent eligibility under 35 U.S.C. § 101 of a computer-implemented invention, should it matter whether the invention is claimed as a method, system, or storage medium; and should such claims at times be considered equivalent for § 101 purposes?

In addition to the parties, the Federal Circuit has also granted leave for the USPTO to participate at oral arguments. The USPTO’s brief focused on practical mechanisms for the process of determining § 101 eligibility. The agency wrote “the essential question under § 101 is whether the claim, properly construed, incorporates enough meaningful limitations to ensure that it amounts to more than a claim for the abstract idea itself . . . This Court should identify a non-exhaustive list of factors for district courts and examiners to consider in resolving that essential question on a case-by-case basis.”

The second patent case (argued first on the 8th) is that of Robert Bosch v. Pylon Mfg. In Bosch, the court is focusing on the “final judgment rule” that limits a losing party’s right to appeal until the district court judgment is finalized. Particularly, 28 U.S.C. § 1292(c)(2) indicates that the Federal Circuit has jurisdiction over patent appeals once the case is “final except for an accounting. The basic question on appeal is: Define “an accounting.” The en banc order asks two particular questions:

a) Does 28 U.S.C. § 1292(c)(2) confer jurisdiction on this Court to entertain appeals from patent infringement liability determinations when a trial on damages has not yet occurred?

b) Does 28 U.S.C. § 1292(c)(2) confer jurisdiction on this Court to entertain appeals from patent infringement liability determinations when willfulness issues are outstanding and remain undecided?

In its brief of the case, the U.S. Government argued that “accounting” encompasses the damage award. As such, the Government argues that appeal is appropriate once liability is determined.

At the Supreme Court, oral argument in Bowman v. Monsanto (patent exhaustion doctrine) is scheduled for February 19; and FTC v. Watson (reverse payment settlements) is scheduled for March 25. Arguments for Association for Molecular Pathology v. Myriad Genetics, Inc.

have not yet been scheduled.

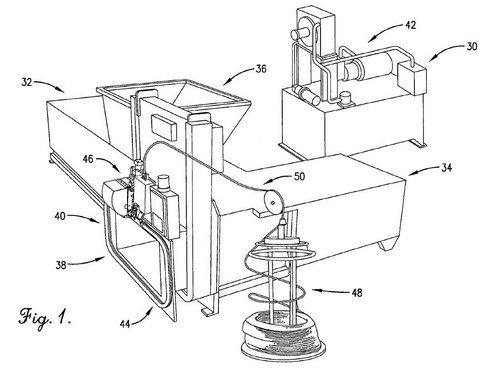

Presume that Claims Cover the Preferred Embodiment

by Dennis Crouch

Accent Packaging v. Leggett & Platt (Fed. Cir. 2013)

In yet another case, the Federal Circuit has altered a district court claim construction in a way that entirely flips the outcome.

In a 2010 action, Accent asserted that L&P infringed its US Patent Nos. 7,373,877 (claims 1–5) and 7,412,992 (claims 1, 3, 4, 7, and 10–14). The patents are directed to a device for baling recyclables or solid waste for easier handling.

The asserted claim required a set of “elongated operator bodies, with each of the operator bodies being operably coupled with a respective one of said gripper, knotter, cutting element and cover so as to supply driving power from the single drive assembly thereto.” Leggett's accused device links together the gripping/knotting/cutting/covering tasks and only requires two operator bodies to accomplish all four tasks. In construing the claims, the district court held that the “each . . . respective one of” language required that each operator body perform only one of the listed tasks. As such, Leggett could not infringe.

On appeal, the Federal Circuit reversed – finding that its interpretation of the claim does not require that “each elongated operator body be coupled to one and only one of these operator elements.” Rather the court found that the language only required coupling with at least one operator element. In its decision, the court relied heavily on the fact that the identified preferred embodiment of the invention showed an operator body operably coupled to both a knotter and a cover.

[I]n the preferred embodiment of the invention, two elongated operator bodies are operably coupled to both the knotter and the cover. Put differently, the preferred embodiment features an elongated operator body that is operably coupled to one or more operator elements. We have held that “a claim interpretation that excludes a preferred embodiment from the scope of the claim is rarely, if ever, correct.” On-Line Techs., Inc. v. Bodenseewerk Perkin-Elmer GmbH, 386 F.3d 1133, 1138 (Fed. Cir. 2004).

One question that I have regarding this particular preferred embodiment canon of construction has to do with amendments made during prosecution. In my view, a narrowing claim language made during the course of prosecution should not carry the same presumption of covering the preferred embodiment. In this case, the claims were completely rewritten during prosecution in order to place the application in condition for allowance. And, the limitations in question were added during prosecution.

The result in this case is major — instead of winning on summary judgment, the Federal Circuit here holds that Leggett & Platt loses on summary judgment and is liable for infringement.

Big Firms and Contingency Fee Struggles: Parallel Networks v. Jenner & Block

by Dennis Crouch

Joff Wild at IAM has posted some interesting reading in the ongoing dispute between the patent assertion entity, Parallel Networks and its former litigation counsel at Jenner & Block. [Link]

According to the pleadings filed by Parallel Networks in Texas state court[link below], Jenner withdrew from its contingency-fee representation of Parallel Networks against Oracle after losing on summary judgment and determining that it was unlikely to win a large award. Parallel Networks then found new counsel and eventually settled the case for about $20 million. Once that case ended, Jenner returned asking for more than $10 million in attorney fees based upon its hourly rates through summary judgment.

Under the representation agreement, both parties had agreed to arbitrate any dispute over fees and an arbitrator awarded Jenner with a $3 million fee. Parallel Networks has now asked the court to set aside the arbitration award – arguing that under Texas law, a contingent fee attorney cannot drop its client simply for economic reasons and then expect to receive any further compensation. The suit also alleges a host of other problems with Jenner & Block representation in both the Oracle litigation and the parallel case against QuinStreet. The bulk of those allegation stem from various internal communications at Jenner involving the risk and potential of the cases that were never communicated to Parallel Networks.

The lawsuit will be interesting to follow because it offers a rare public glimpse inside big-firm contingency fee structures and the associated political struggle raised by many risk-averse firm leaders. Here, that attempted risk aversion may well cost the firm several million dollars in fees.

I should note that Professor David Hricik testified on behalf of Parallel Networks in the Arbitration. Hricik is on leave from his Patently-O writing as he clerks at the Federal Circuit. I have not spoken with him about this case. – Dennis

Docs: