by Dennis Crouch

In their recent article, Professors Mauro Bambi and Sara Eugeni from Durham University (UK) propose an intriguing hypothesis connecting patent-driven innovation with the global dominance of reserve currencies, particularly the US dollar. They look at Patent Cooperation Treaty (PCT) applications over the years, including high-value "triadic" patent families and argues that higher patenting activities significantly influence central banks' decisions to hold a particular currency as a reserve asset. Eugeni, Sara and Bambi, Mauro, Silicon Valley and the Greenback: Does US Innovation Fuel the Dollar's Global Dominance? (Working Paper from June 26, 2025).

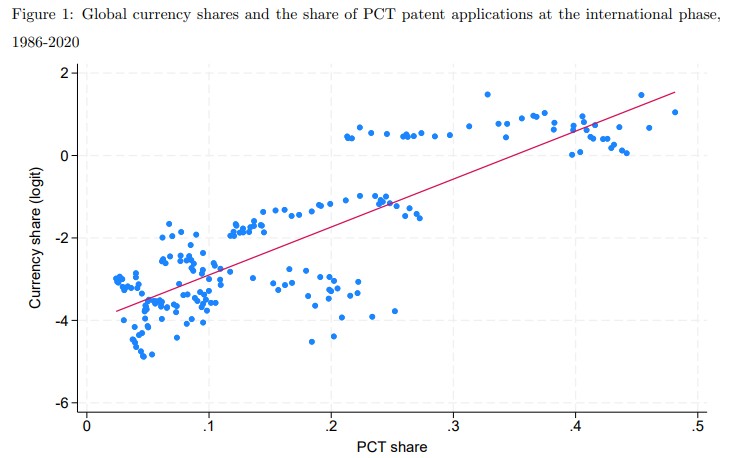

Figure 1 from their paper (above) visualizes this correlation: as a country's share of PCTs increase, so too does the share of its currency in global reserves.

To continue reading, become a Patently-O member. Already a member? Simply log in to access the full post.