by Dennis Crouch

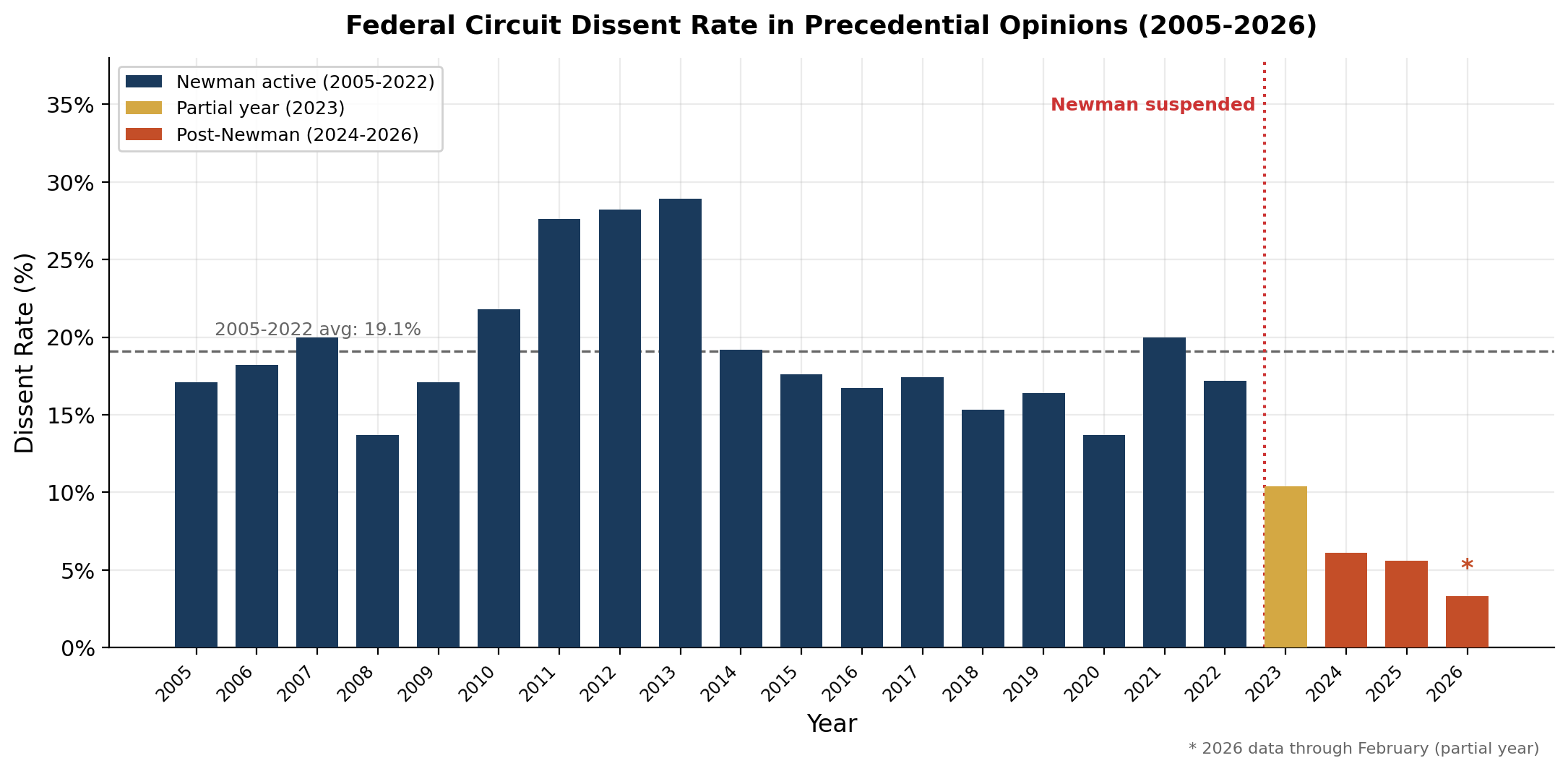

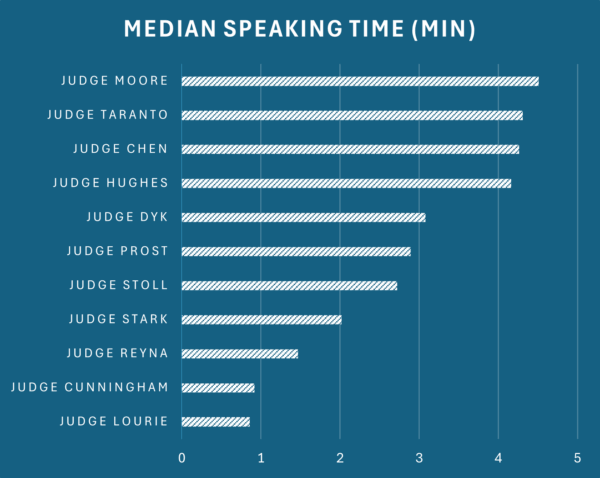

Justice John Marshall Harlan earned the title "The Great Dissenter" of the 1800s. Judge Pauline Newman holds that title for the millennium era - with over 300 dissents in precedential cases in just the final two decades of her tenure alone. To an extent that existing scholarship has only begun to capture, Newman's voice of disagreement defined the Federal Circuit's internal dialogue on patent law. An empirical analysis of almost 5,000 precedential Federal Circuit opinions issued between 2004 and early 2026 reveals just how dramatically this one judge shaped the court's culture. We now have two full calendar years of post-Newman data, and the results are striking: in 2024 and 2025, the court's dissent rate fell dramatically. The Federal Circuit has become, in the space of two years, one of the most consensus-oriented appellate courts in the federal system.

The data tell a straightforward story. From 2005 through 2022, the Federal Circuit's dissent rate in precedential opinions averaged about 19%. In some years it ran higher: the 2011-2013 period saw rates of >25%, the highest sustained period of disagreement in the dataset, driven by the doctrinal upheaval surrounding both Alice and the America Invents Act. In other years the rate dipped to around 13-14%. But it never once fell below double digits. In 2023, the year Newman was suspended from the bench, the rate dropped to 10%. In 2024, it fell to 6%,; and in 2025 the rate was even lower. The Federal Circuit's dissent rate is settling into a new equilibrium roughly one-third of what it was for the prior two decades.

The structural explanation for this decline is not complicated: Judge Newman dissented far more frequently than any of her colleagues, and when she was removed, the dissents left with her. But the magnitude of the effect is actually much greater than what can be accounted for from Newman's direct impact on panel opinions. As discussed below, the court's dissent rate has fallen not just by the amount attributable to Newman's own dissents, but to roughly half the historical baseline of even non-Newman panels—suggesting her departure transformed the court's broader culture of disagreement.

To continue reading, become a Patently-O member. Already a member? Simply log in to access the full post.