Guest post by Jonathan Stroud. Stroud is General Counsel at Unified Patents – an organization often adverse to litigation-funded entities.[1] He is also an adjunct professor at American University Washington College of Law.

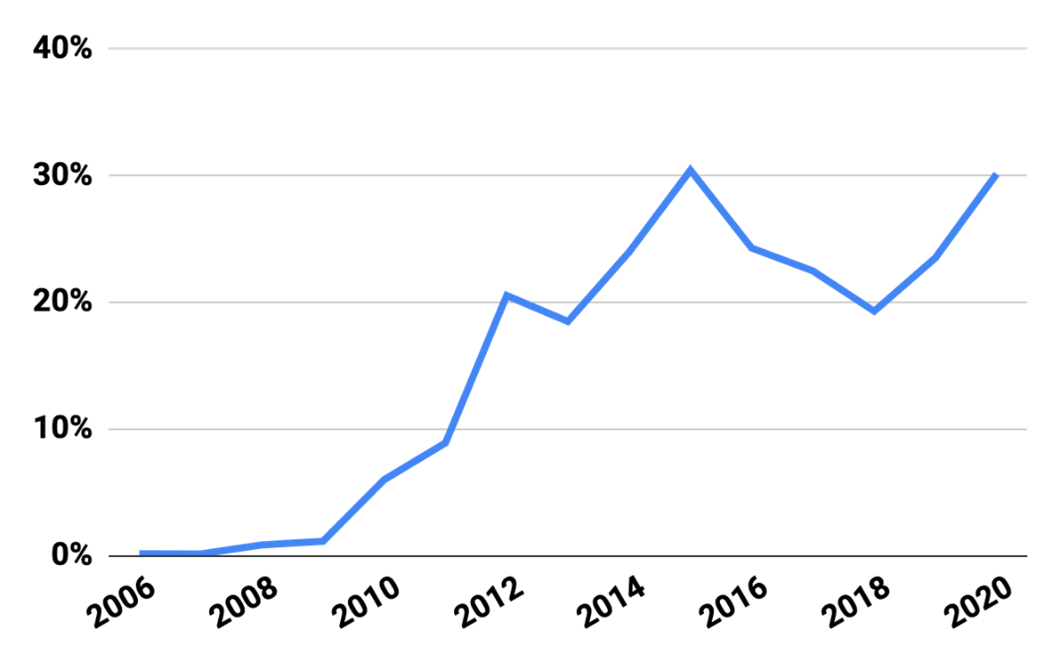

Patent assertion finance today is a multibillion-dollar business.[2] Virtually nonexistent in the patent space in the U.S. ten years ago—at least in part due to longstanding common law rules on champerty, maintenance,[3] and patent law’s relative high risk—today third-party litigation funding (TPLF)[4] undergirds about 30% of all patent litigation, by conservative estimates.[5] Insurance options are suddenly plentiful,[6] funders are expanding and multiplying,[7] and new deal commitments are on the rise.[8] This general trend is seen in the first chart below, adapted from a recent white paper by Korok Ray.[9]

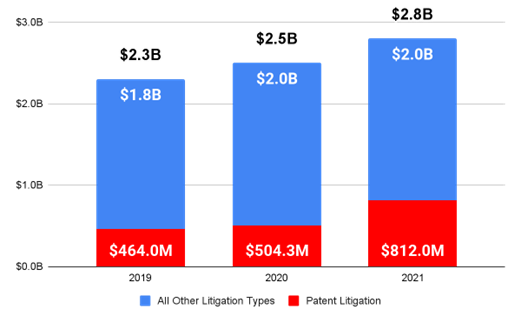

That is in no small part due to it being the fastest-growing piece of the wider U.S. litigation finance boom of the past 20 years—as has been widely reported, private equity now undergirds huge swaths of U.S. bankruptcy, class action, trademark, securities, and tort litigation, to the tune of $50 to $100 billion in investments annually.[10] According to one of the biggest litigation funders, publicly traded Burford Capital—recently featured on 60 Minutes[11]—there was a 237% increase in overall litigation funding in the US between 2012 and 2018, a trend that, by all accounts, continues unabated.[12] Industry reports show new investments pouring fastest into patent infringement litigation; new deal commitments for TPLF saw an increase of 61%; and patent litigation accounted for 29% of all new commitments by TPLFs in 2021.[13] Recent trends are shown in the chart below, adapted from a Westfleet Advisors report. [14]

In terms of how TPLF is structured, deals are variegated, complex private agreements. But generally the funder will offer non-recourse funding (or funding that is “at risk”) upfront to cover expenses in exchange for being first in line to recoup all of that funding first (i.e., to be “paid back”) out of any recovery, and then to take some hefty percentage—often 60% or more of whatever is remaining, particularly in litigations deemed high-risk (like patent litigation), though there are no rules governing how much funders can ask for. (It generally amounts to more than 50% of the total settlement recovery, acknowledging, at least by basic math, that they are the primary beneficiary of the litigation.). Sometimes all fees are paid upfront by the funder (Fortress is known for this); some pay some continuing level of a fee/contingency split with firms to split risk; some pay the original patentholder upfront, though others think that disincentivizes them from robust ongoing participation; others make all recovery, for all parties in a waterfall, contingent upon settlement. Many start with and later add investors to ongoing funds and matters. Nearly all require oversight and consultation at all key decision points.

Patent TPLF funds generally promise roughly 20% internal rates of return to funders (IRR) year-over-year, or about a 2x to 2.5x return on investment over generally four- or five-year investment cycles, suggesting, at least at the pitch level, that these investments are lucrative for the funders.[15] The biggest (or at least most well-known) players—Magnetar Capital, Burford Capital, Fortress Investment Group, Omni Bridgeway, and Curiam Capital, to name just a few[16]—have funded patent cases for years, reporting in some cases that their existing funds were on pace to return 20% or more—less than some other investments tout, but still beating the market by a fair margin.[17]

At least, that’s as far as can be pieced together. What we do know comes mostly from self-reporting, industry reports, and journalists. That’s because current disclosure of litigation funding relies on a patchwork of state law, court rules, self-reporting, FOIA requests, leaks to journalists, and funding pitches. It’s true today that no one in the government (Federal or state, judicial, legislative, or executive) knows who is funding which litigations, whether they are as profitable as they claim to be, if they are being properly taxed, or even how they are generally structured. Disclosure is limited even for the two well-known, publicly traded litigation fund managers, Burford Capital and Omni Bridgeway; it is sparser still—and highly self-selective—for all the private funds involved. According to a recent Government Accountability Office (GAO) report on litigation funding (written at Congress’ behest), “[e]xperts GAO spoke with identified gaps in the availability of market data on third-party litigation financing, such as funders’ rates of return and the total amount of funding provided,” and noted that no government body is aware of who is funding these cases, who is influencing or controlling them, or what promises they are making to investors.[18] (It also notes litigation finance industry lobbying groups active today, and their membership.)

Disclosure remains sparse at least in part because the very wealthy private investors who fund litigation claims and then reap, they claim, windfall profits—some of them concededly foreign sovereign nation funds[19]—have fought hard to keep those agreements secret, even from judges asking for disclosure, much less from government officials, researchers, reporters, opposing parties, or the public. As such, the Federal District Court of Delaware has recently found itself at the center of this high-stakes debate about transparency and the purpose of the courts.

In April of 2021, the District of Delaware’s Chief Judge, Colm Connolly, issued two standing orders requiring litigants to, inter alia, disclose third-party litigation funding.[20] (The orders apply to all parties and litigation before his Court, not just parties to patent disputes, but do not extend, as yet, to the other sitting judges there.) The orders were neither ultra vires nor exceptional—The Federal Rules of Civil Procedure have been moving toward greater ownership transparency for years, the advisory committees have recommended that judges have the right to such disclosure and are considering further requirements,[21] and similar requirements in Federal District courts across the nation have been in place for years, in districts in, for example, California, Georgia, Iowa, Maryland, Michigan, Nevada, New Jersey, Ohio, and Texas (in the Western district).[22] But that trend toward disclosure had thus far largely avoided being raised and enforced in the few Federal districts where patent litigation primarily resides (though the California and Texas districts have long had rules requiring disclosures—ones that are often ignored by LLC PAEs).

To continue reading, become a Patently-O member. Already a member? Simply log in to access the full post.