Guest post by Gary L. Griswold. Mr. Griswold is a Consultant residing in Hudson, WI and was formerly President of and Chief Intellectual Property Counsel for 3M Innovative Properties Company. The paper reflects the views of the author. He wishes to thank Bob Armitage and Mike Kirk for their excellent contributions to the essay.

In August, 2015, I published an article on Patently-O entitled “35 USC 289-After Apple v Samsung, Time for a Better-Crafted Judicial Standard for Awarding “Total Profits.” [i] The article appeared before the Supreme Court granted certiorari in this appeal.[ii] My use of the word “after” was, thus, a bit premature. The crafting of a new judicial standard may actually be accomplished over the next several months, as the Supreme Court considers the damages issue in Apple v. Samsung case later in its current term.

The statutory basis for awarding damages in this case is no “small-change.” 35 USC 289 provides the design patent holder with the infringer’s “total profits” on the “article of manufacture” to which the patented design “has been applied”[iii]. My August article referenced a Patently-O article by Professor Rantanen that included an analysis of the Federal Circuit’s Apple v Samsung decision and its ramifications, suggesting that the section 289 damages provision could induce “an explosion of design patent assertions and lawsuits.”[iv] Indeed, section 289 holds the potential for design patent procurement and assertion to become the next big “patent assertion entity” business model.

Some commentators have suggested that design patents, being sought and accumulated differently from utility patents, are not likely to stimulate much PAE interest. Whatever merit in that view, it needs to be tempered with the realization that greed is the mother of all of this type of business-model invention. One need only reflect on the fact that more than 1,000 qui tam actions for false marking were filed by opportunistic plaintiffs following the 2009 Federal Circuit decision in Forest Group, Inc. v. Bon Tool Co. before such actions were thankfully banished by the “Leahy-Smith America Invents Act.”[v] The prospects for design infringement revenue generation based on the “total profits”-recovery provision in 35 USC 289 could make successful design patent assertion a staggeringly profitable business. The potential for such an outcome as well as an example of such assertion was referenced in the briefs relating to the Apple v. Samsung certiorari petition[vi].

The possibility of a surge in design-patent PAE activity is almost certainly one of many reasons why the Supreme Court granted certiorari—and why it should not squander the opportunity presented in the Apple v. Samsung appeal to provide a reasoned and principled demarcation between those fact patterns where a “total profits” remedy is clearly warranted and those where it is not.

In deciding this appeal, the Supreme Court may focus on what constitutes an “article of manufacture” under section 289. The statute provides a design patent infringer “shall be liable to the [design patent] owner to the extent of [the infringer’s] total profit” if the infringer “applies the patented design … to any article of manufacture.” [vii](emphasis added) But, the patented design is not necessarily synonymous with the article of manufacture itself.

Indeed, for section 289 purposes, an “article of manufacture” has been held to be the entire substrate to which the patented design is applied. For example, it has been held that a boat becomes the “article of manufacture” when the patented design is for the windshield applied to the boat[viii]. Other examples of “articles of manufactures” whose total profits might be subject to a section 289 recovery include (1) a large agricultural combine, when the patented design is for a tire tread applied to a tire used on the combine; (2) an automobile, when the patented design is for the automobile’s rear taillights; and (3) an HDTV, when the patented design is for a semiconductor used in the television.

In my earlier articles, I described such “total profits” recovery scenarios as a problem in need of a judicial solution. I suggested eliminating access to section 289 “total profits” recoveries in situations where a consensus exists that a remedy of this type would be entirely unwarranted. My approach would interpret section 289 as authorizing a total-profits recovery only “if the patented design is substantially the basis for customer demand for the entire article”.[ix] If it is the basis for consumer demand, the section 289 total-profits recovery would apply to the article; if not, a recovery of total profits would not be available for the article.

This approach bears some similarity to the determination of utility patent damages under the entire market value rule[x]. A utility patent on a boat windshield does not allow the value of the boat to be used as the basis for determining a reasonable royalty absent a demonstration that the windshield was the basis for the customer demand for the boat.

In addition, the “customer demand” limitation is consistent with the apparent rationale for enacting section 289 in the first place. Current section 289 and its predecessors replaced a Supreme Court decision[xi] that provided limited damages to design patent owners even where the infringers had applied the patented design to an article of manufacture in order to create the customer demand for the article of manufacture. In such a situation, forcing the copyist to turn over its total profits obtained on the infringing article represents good policy.

However, even under a “customer demand” limitation, section 289 is no timid remedy. It would not involve any form of “apportionment” of the profits to be awarded to the design patent holder on the ground that some proportion of the profits might be attributable to non- design patented factors. Apportionment is not consistent with the Congressional intent when section 289 and its predecessors were enacted.

Moreover, even if the section 289 remedy is unavailable, the patent owner is not left without the right to recover damages. All the remedies otherwise available for patent infringement remain, whether or not a section 289 “total profits” recovery can be secured as long as there is no double recovery of damages[xii].

The Apple v. Samsung case is of particular importance because imposing the “customer demand” standard on section 289 recoveries does not require another act of Congress. The courts are free to interpret statutes to effectuate the purpose Congress had in enacting them. Under section 289, Congress did nothing to preclude the courts from determining what qualifies—and does not qualify—as an “article of manufacture.”

The Federal Circuit sees this judicial flexibility otherwise. It (incorrectly) saw its hands as having been tied by Congress in Apple v. Samsung, stating: “We are bound by what the statute says, irrespective of policy arguments that may be against it”[xiii]. Fortunately, the Supreme Court has the opportunity to see the situation differently.

The Supreme Court may—and should—see it differently. It can define an “article of manufacture” as being limited to objects for which the patented design is substantially the basis for customer demand. Courts have acted similarly in the past to assure that application of a statute will not result in foreseeable outcomes which are clearly inappropriate and manifestly unintended. The emergence of the “entire market value” rule is a good example of where the alleged “infringing product” cannot be reflexively used as the basis for a damages calculation where the “patented invention” is a mere component or feature of the product and not the product itself.

The Court will have, however, some competing approaches to consider in the course of deciding this appeal. Another possible approach to interpreting section 289 is the so-called “separate product” exception. This exception to a section 289 recovery limits the availability of total profits to the smallest separately sold product to which the patented design is applied. While this exception has the potential to limit the possibility of some of the ludicrous outcomes noted above, it is no panacea. For example, it fails to exclude a section 289 recovery where a design patented graphical user interface (GUI) is used in an electronic device which does not involve a separately sold product. This is a serious deficiency because of the difficulty in finding any policy rationale for awarding total profits on an electronic device simply because a design on a GUI used in it is patented.

Apple has, nonetheless, suggested in its responsive brief to “Defendant-Appellants’ Petition for Rehearing en banc” what amounts to a more generalized rendition of a “separate product” exception: “As the panel correctly recognized, this distinctive design was not severable from the inner workings of Samsung’s smartphones, see Op.27-28, in a way that a cupholder is analytically distinct from the overall look-and-feel of a car.”[xiv] (emphasis added) While “severability” appears to be a more general “exception” criterion than simply being a “separate” product, the “severability” approach does not appear to address the deficiency explained above for the “separate product” exception.

If there is a concern with the “customer demand” limitation, it would be whether the limitation is so broad that it swallows most or all of the “total profits” rule. Indeed, there are many factors which cause a purchaser to acquire a particular article of manufacture—most notably its functional aspects. However, to apply the “customer demand” approach, one begins with the customer looking for something in a product space and then making the specific decision to purchase. Everyday products with new, ornamental designs such as specially shaped paper clips are a good example.[xv] While they have a known function, they are most likely purchased for their appearance. An option would be to only consider the ornamental features of a product to determine whether they were substantially the basis for customer demand, but that may well be too narrow and could lead to a total profit remedy for minor differences from an ornamental perspective.

The Supreme Court would not have granted certiorari without a sense that its guidance was needed to properly titrate a powerful damages provision. It can best do so by allowing section 289 to remain a viable incentive to create and commercialize new designs, but then limiting the articles of manufacture qualifying for a “total profits” recovery to those where the patented design is substantially the basis for customer demand for the article of manufacture. Such a holding would secure section 289 as both a distinguishing and distinguished feature of U.S. design patent law.

[i] Griswold, Gary. “35 USC 289 – After Apple v. Samsung, Time for a Better-Crafted Judicial Standard for Awarding “Total Profits”? Patently-O. August 14, 2015. https://patentlyo.com/patent/2015/08/griswold-patent-damages.html

[ii] See U.S. Supreme Court Orders List from March 21, 2016 at 2. http://www.supremecourt.gov/orders/courtorders/032116zor_h3ci.pdf

[iii] 35 U.S.C. § 289:

“Whoever during the term of a patent for a design, without license of the owner, (1) applies the patented design, or any colorable imitation thereof, to any article of manufacture for the purpose of sale, or (2) sells or exposes for sale any article of manufacture to which such design or colorable imitation has been applied shall be liable to the owner to the extent of his total profit, but not less than $250, recoverable in any United States district court having jurisdiction of the parties.

Nothing in this section shall prevent, lessen, or impeach any other remedy which an owner of an infringed patent has under the provisions of this title, but he shall not twice recover the profit made from the infringement.”

[iv] Rantanen, Jason, “Apple v. Samsung: Design Patents Win.” Patently-O. May 18, 2015. https://patentlyo.com/patent/2015/05/samsung-design-patents.html

[v] Laurie Rose Lubiano, “The America Invents Act applies the brakes to the false marking bandwagon.” LEXOLOGY, January 3 2012. http://www.lexology.com/library/detail.aspx?g=401c9bea-d643-4521-bc7d-c63d5b4a25f5

[vi] Samsung Petition for a Writ of Cert. Case No. 15-777. at 36-38. http://www.scotusblog.com/wp-content/uploads/2016/01/15-777_PetitionForAWritOfCertiorari.pdf

[vii] 35 U.S.C. § 289

[viii] Order on Motion for Partial SJ, In re Pacific Coast Marine Windshields Ltd. v. Malibu Boats LLC, Case No. 6:12-cv-33 (M.D. Fl. August 22, 2014)

[ix] See Griswold, https://patentlyo.com/patent/2015/08/griswold-patent-damages.html; See also Griswold, Gary. “35 USC § 289 – An Important Feature of U.S. Design Patent Law: An Approach to its Application.” IPO Law Journal. April 6, 2015. http://www.ipo.org/wp-content/uploads/2015/04/griswold_an-approach.pdf

[x] See Cornell University v. Hewlett-Packard Co., 609 F.Supp. 2d 279, 288-89 (N.D.N.Y. 2009):

(1) The infringing components must be the basis for customer demand for the entire machine including the parts beyond the claimed invention, (2) the individual infringing and non-infringing components must be sold together so that they constitute a functional unit or are parts of a complete machine or single assembly of parts, and (3) the individual infringing and non-infringing components must be analogous to a single functioning unit. It is not enough that the infringing and non-infringing components are sold together for business advantage. Notably, these requirements are additive, not alternative, ways to demonstrate eligibility for application of the entire market value rule.

See also Virnetz, Inc. v. Cisco Systems, Inc., 113 F.3d 1308, 1326 (Fed. Cir. 2014) (Judge Prost: “we recently affirmed that ‘[a] patentee may assess damages on the entire market value of the accused product only where the patented feature creates the basis for customer demand or substantially creates the value of the component parts.”)

[xi] See Dobson v. Dornan, 118 U.S. 10, (1886); Dobson v. Hartford Carpet Co., 114 U.S. 439 (1885); Dobson v. Bigelow Carpet Co., 114 U.S. 439 (1885); Bigelow Carpet Co. v. Dobson/Hartford Carpet Co. v. Same, 10 F. 385,386; 1882 U.S. App. LEXIS 2295 (E.D. Pa. 1882).

[xii] 35 U.S.C. § 289, paragraph 2: “Nothing in this section shall prevent, lessen, or impeach any other remedy which an owner of an infringed patent has under the provisions of this title, but he shall not twice recover the profit made from the infringement.”

[xiii] Apple v. Samsung, Fed. Cir. Opinion at 27, fn. 1.

[xiv] See Brief in Opp’n to Rhg, Apple v. Samsung, Case No. 2014-1335; 2015-1029 at 27-28 (Fed. Cir. July 20, 2015)

[xv] See, e.g., Design Patent No. USD647,138: https://docs.google.com/viewer?url=patentimages.storage.googleapis.com/pdfs/USD647138.pdf

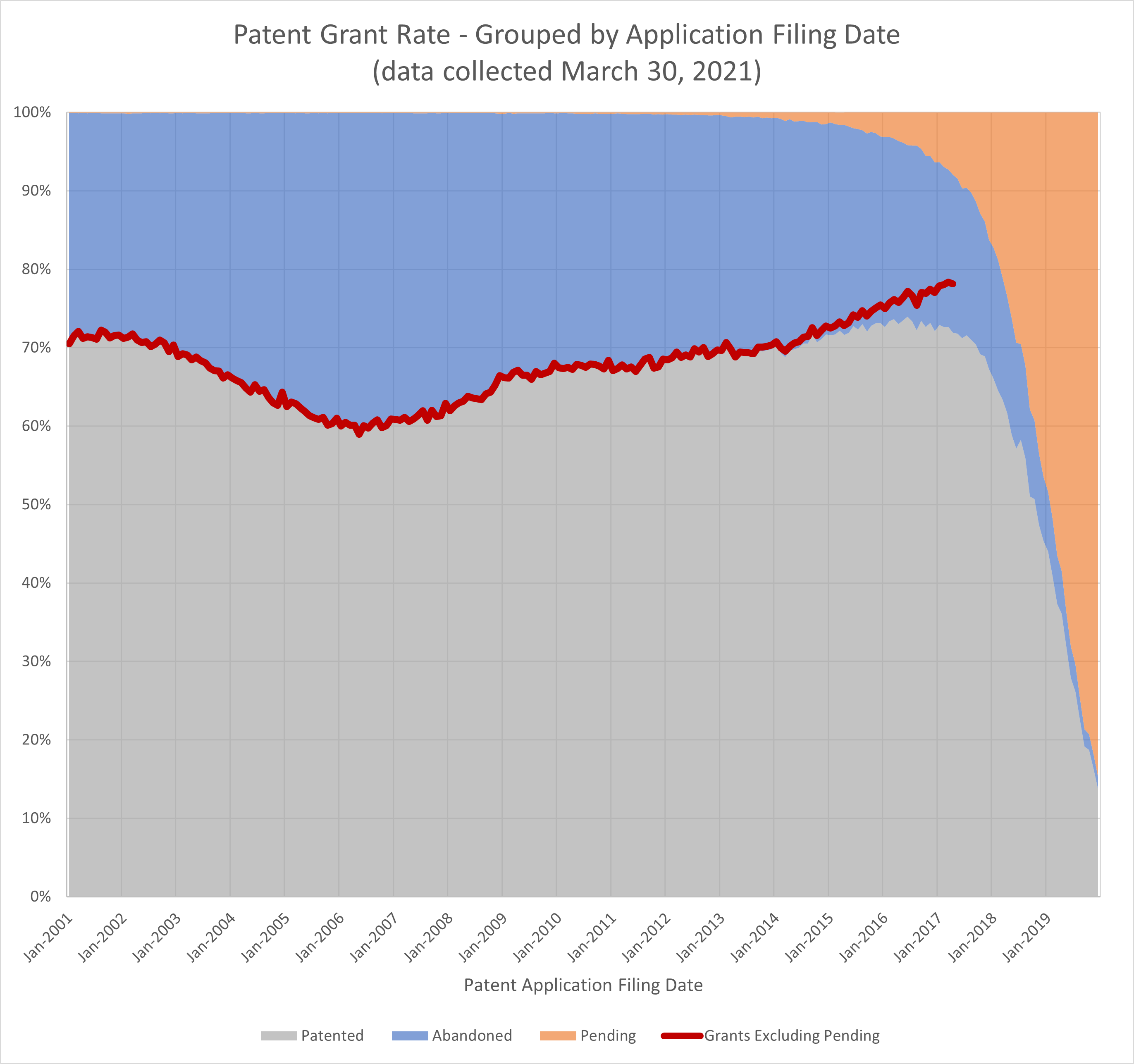

Two former Boston University Law School Colleagues occupied New York Times headlines on Sunday in a discussion of the economics of patent law. Michael Meurer and Jim Bessen are both economists and both law professors. Over the past few years, the pair has compiled a tremendous amount of economic data regarding patents and companies who patent.

Two former Boston University Law School Colleagues occupied New York Times headlines on Sunday in a discussion of the economics of patent law. Michael Meurer and Jim Bessen are both economists and both law professors. Over the past few years, the pair has compiled a tremendous amount of economic data regarding patents and companies who patent.  Meurer & Bessen do not suggest dismantling the patent system — rather, they believe that a number serious reform measures are needed to shift the balance back to a positive state where patents incentivize innovation.

Meurer & Bessen do not suggest dismantling the patent system — rather, they believe that a number serious reform measures are needed to shift the balance back to a positive state where patents incentivize innovation.

Harvard’s Journal of Law & Technology is generally considered on of the top two academic journals focusing on Law & Technology (along with

Harvard’s Journal of Law & Technology is generally considered on of the top two academic journals focusing on Law & Technology (along with