by Dennis Crouch

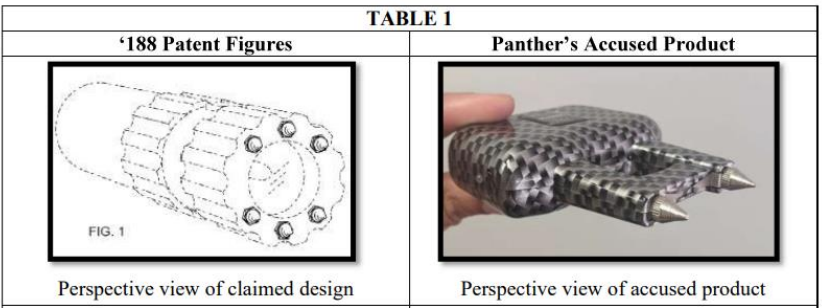

In PS Products, the Federal Circuit has affirmed that district courts may impose deterrence sanctions under their inherent powers even after (or in addition to) awarding attorney fees under 35 U.S.C. § 285. PS Prods. Inc. v. Panther Trading Co., No. 2023-1665 (Fed. Cir. Dec. 6, 2024).

To continue reading, become a Patently-O member. Already a member? Simply log in to access the full post.