Tag Archives: Supreme Court

IP Issues in the Supreme Court Calendar

RIM, with the support of Canada and Intel, Ask Court for Another Review of BlackBerry Patent Case

Supreme Court: FTC confronts decision that liberally allows brand-generic patent settlements

Supreme Court Asked to Raise Standard for Obtaining Injunctive Relief

Grokster Loses at Supreme Court

Supreme Court to Reexamine the Interplay Between Patents and Unlawful Tying Agreements

Merck v. Integra: Supreme Court Reverses, Broadens Statutory Experimental Use Safe Harbor

Government Opposes Supreme Court Review in Festo Remix

Caterpillar Petitions Supreme Court on Issue of Implied Bias of Jury Members

Caterpillar v. Sturman (on petition for writ of certiorari).

In 2004, the Court of Appeals for the Federal Circuit vacated a jury verdict in a trade secret and contract dispute involving Caterpillar. [Article]. The problem involved Juror No. 3, whose spouse was a current Caterpillar employee — and thus potentially biased.

Normally, the question of whether an individual juror is biased is a factual determination entitled to deference on appeal. However, the CAFC ruled that the district court’s decision was based on “implied bias, as opposed to actual bias” and thus is reviewed de novo. Applying Seventh Circuit law, the court found the implied bias is demonstrated by “showing that the juror has a personal connection to the parties or circumstances.” As such, the spouse’s presence on the jury created an implied bias sufficient to vacate the judgment.

Now, Caterpillar has asked the U.S. Supreme Court to review the case. In its petition for writ of certiorari, Caterpillar argues that the CAFC’s decision to “automatically disqualify the spouse of an employee of a party” is in conflict with the Second, Fourth, Fifth, Sixth, Eighth, Seventh and Eleventh circuits. The petition cites Smith v. Phillips (1982) for the proposition that “implied bias doctrine is not viable for parties challenging jurors on a per se basis. Caterpillar also argues that Sturman should not be able to argue implied bias because the company failed to use its peremptory challenges to protect against potentially biased jurors.

In its brief filed in opposition, Sturman argues that (i) there is “no circuit split” on the issues raised by Caterpillar; (ii) that the CAFC properly applied Seventh Circuit and Supreme Court law; and (iii) that Caterpillar did not raise its current argument below. Sturman notes that the implied bias has a long history of application “stretching back to Blackstone’s day.” Sturman also dismisses the importance of the case — since the CAFC’s interpretation of Seventh Circuit law is not binding precedent.

Supreme Court: Patent Professors Support Tighter Obviousness Standard

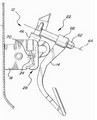

In January 2005, the CAFC decided Teleflex v. KSR — holding that there must be a suggestion or motivation to combining two or more references in an obviousness finding. This “teaching-suggestion-motivation test” has been a stalwart of Federal Circuit obviousness jurisprudence for twenty years. During that time, the Supreme Court has not heard a single obviousness case.

KSR has petitioned the Supreme Court for a writ of

and Sakraida (1976). In Sakraida, the High Court held that a combination which only unites old elements with no change in their respective functions is precluded from patentability under 103(a). Under the Sakraida standard, the Teleflex patent is arguably

obvious. Although patent cases are rarely heard by other circuit appellate courts, a circuit split remains between the CAFC and several other circuits on this issue.

I. Brief of Twenty-Four Law Professors:

art (PHOSITA) and simply consults the scope and content of the prior art references. At best, the appellate court has relegated the PHOSITA to the role of a “reference librarian, assisting in locating appropriate prior art references but apparently incapable of applying them in light of his or her knowledge or skill.”

The brief notes that this case is a good one for cert: simple technologies, procedurally clean, and experienced counsel for both sides.

The twenty-four professors include Robert Brauneis, Katherine Strandburg, Margo Bagley, James Bessen, Michael A. Carrier, Rochelle Cooper Dreyfuss, Christine Haight Farley, Cynthia M. Ho, Timothy R. Holbrook, Peter Jaszi, Jay P. Kesan, Mark A.

Lemley, Glynn S. Lunney, Jr., Ronald J. Mann, Robert P. Merges, Kimberly A. Moore, Janice M. Mueller, Joseph Scott Miller, Craig A. Nard, Malla Pollack, Arti K. Rai, Pamela Samuelson, Joshua

Sarnoff, and John R. Thomas. Of course, John F. Duffy would be twenty-five, but he already signed on to the original KSR petition.

Download the Professor’s Brief: KSR Amicus 24 Professors.pdf (276 KB).

II. Brief of the Progress & Freedom Foundation:

PFF’s brief focuses on the “growing unease about patent quality” as a justification for tightening the standards for obviousness. According to the brief, a loose obviousness standard undermines the basic justification for the patent

system and encourages people to hamstring the system.

Download the PFF Brief: ProgressFreedomFoundation.pdf (206 KB)

- KSR Petition for Cert (760 KB) (Including CAFC and District Court decisions in Appx);

24 Professors in support of petition.pdf (276 KB);

- Progress Freedom Foundation in support of petition.pdf (206 KB);

- Animation of the subject matter of the invention. Prepared by Demonstratives, Inc. of Ames Iowa.

IV. Links:

- Patently-O Prior Discussion of the CAFC decision.

- European Attorney Axel Horns hopes that this case may spark a similar debate in Europe over the could/would approach of the EPO.[Article].

- Ernest Miller has thrown his hat in support of the petition — although he just wants a nice precedential opinion. [Blink].

V. Misc:

One question that I asked Professor Brauneis is whether increasing the obviousness standard would disproportionately affect small businesses and individual inventors who may be more likely to invent through by combining well known items in a novel fashion. In reply, Brauneis noted that while corporate researchers may have more resources to invent from whole-cloth, corporate law departments also have more resources to file dubious patent applications for strategic purposes. For Brauneis and the 24–professors, the bottom line is that “if the claim in the patent application describes something that would be obvious to a person having ordinary skill in the art, it’s bad policy to grant the patent.

For those interested in this issue, there is still time to file with the Court.

Merck v. Integra: Supreme Court Hears Drug Development Patent Case

On April 20, 2005, the Supreme Court heard oral arguments in the case of Merck KGaA v. Integra (Statutory safe harbor for drug development activity). However, the oral arguments do not appear to have raised any new issues that will impact the case.

The High Court was critical of the Federal Circuit prose:

- “not a crystal clear opinion by any means” (J. Ginsburg).

- “pretty foggy” (J. Breyer).

These remarks did not extend to the substance of the opinion. Book-makers expect that the CAFC’s decision will be at least partially reversed — the real question is the eventual breadth of the statute.

In January 2005, Tom Mauro of the Legal Times reported that Justices Sandra Day O’Connor and Stephen Breyer did not participate in the decision to grant cert. Interestingly, both Justices took part in the oral arguments.

A decision is expected this summer.

Links:

-

Patently-O: Information on the case

Merck KGaA v. Integra: Supreme Court Set to Hear FDA Safe Harbor Case

On April 20, 2005, the Supreme Court will hear Merck KGaA v. Integra to determine boundaries of the statutory safe harbor created by 35 USC 271(e)(1). The safe harbor immunizes would-be infringing activity when the activity is done while preparing an FDA application for drug approval. Attorneys for both Merck and Integra as well as for the U.S. Government are expected to present oral arguments.

Merck KGaA has now filed its reply brief that focuses on picking-apart Integra’s answer. In particular, Merck begins its argument with the statement that “everyone agrees” that “preclinical experiments reasonably related to an IND application are immune from patent infringement claims as clinical trials.”

Importantly, Merck challenged Integra’s procedural argument that the is “no present controversy.” This issue is one that could allow the High Court to completely avoid deciding the important statutory issues.

The SCOTUS Blog provides an excellent preview of the case here.

Briefs on the Merits:

- In Support of Merck:

- Brief by Petitioner Merck KGaA

- Reply Brief by Petitioner Merck KGaA

- NY Intellectual Property Law Association’s Brief

- EON Labs Brief

- AARP Brief

- Amicus Brief for the Consumer Project and the Electronic Frontier Foundation (EFF)

- PhRMA Amicus Brief

- Amicus Brief for Sepracor

- Brief of Genentech and Biogen Idec

- Brief for the United States Government

- Brief of Amici Curiae Eli Lilly, Wyeth, and Pfizer

- Professors’ Amicus Brief

- AIPLA Amicus Brief

- Bar Association of the District of Columbia (BADC) Brief

- San Diego Intellectual Property Law Association (SDIPLA) Brief

- Biotechnology Industry Organization (BIO) Brief

- Brief by Respondent Integra

- Benitec Amicus Brief

- Vaccinex Amicus Brief

- Applera and Isis Amicus Brief

- Invitrogen Amicus Brief

- WARF Amicus Brief

Stage Set For Hearing on Experimental Use Safe Harbor Statute at Supreme Court

Party and amicus briefs have been filed and the stage is now set for the April 20 hearing of Merck KGaA v. Integra LifeSciences at the Supreme Court.

Merck v. Integra is slated to determine the scope of 35 U.S.C. §271(e)(1), the safe harbor statute that permits a drug manufacturer to perform potentially infringing experiments needed to obtain FDA approval without incurring liability for patent infringement. A major question will be how attenuated an experiment may be and still fall within the protection from infringement liability offered by the statute.

I have summarized the various party and amicus briefs here. The following links provide PDF copies of the briefs.

In Support of Merck:

- Brief by Petitioner Merck KGaA

- Brief for the United States Government

- Brief of Amici Curiae Eli Lilly, Wyeth, and Pfizer

- EON Labs Brief

- AARP Brief

- Amicus Brief for the Consumer Project and the Electronic Frontier Foundation (EFF)

- PhRMA Amicus Brief

- Amicus Brief for Sepracor

- NY Intellectual Property Law Association’s Brief

- Brief of Genentech and Biogen Idec

In Support of Integra:

- Brief by Respondent Integra

- Benitec Amicus Brief

- Vaccinex Amicus Brief

- Applera and Isis Amicus Brief

- Invitrogen Amicus Brief

- WARF Amicus Brief

In Support of Neither Party:

Congress Discusses Which Court Should Hear Patent Cases

The AIPLA is supporting a measure to legislatively overrule the 2002 Supreme Court case of Holmes Group v. Vornado. The House Subcommittee on Courts, the Internet, and Intellectual Property is holding a hearing today to discuss the matter.

Specifically, the AIPLA argues that the holding will allow regional circuits and even state courts to begin to hear patent counterclaims. This scenario was suggested by the Indiana Supreme Court ruling in Green v. Hendrickson Publishers, Inc., 770 NE2d 784, 63 USPQ2d 1852 (< ?xml:namespace prefix ="" st1 />

The Subcommittee hearing is scheduled for 3:30 p.m. Eastern and will be broadcast over the Internet here. Those testifying include Edward Reines on behalf of the Federal Circuit Bar Association; Professor Arthur Hellman from the University of Pittsburgh School of Law and expert on the structure of the Courts; Sanjay Prasad, Chief Patent Counsel for Oracle Corporation, and Meredith Martin Addy from Brinks Hofer.

Although the cameras would normally be focused tightly on the patent hearing, as Matthew Buchanan points out, MLB is also testifying today on the Hill.

LINK:

< ?xml:namespace prefix ="" o />

Appeals Court Partially Reverses eBay Patent Case: Setting the Stage for a Permanent Injunction

MercExchange v. eBay (Fed. Cir. 2005)

by Dennis Crouch

At the district court level, Thomas Woolston, creator of the MercExchange and Patently-O Reader, won a $35 million patent infringement suit against eBay for infringement of his patents covering live internet auctions. On March 16, 2005, the Federal Circuit released its decision on appeal, reversing the decision in-part, but setting the stage for a permanent injunction against eBay.

On appeal, the Federal Circuit partially overturned the district court’s decision, finding that at least one of the MercExchange patents invalid but vacating the lower court’s ruling that another patent was invalid.

Perhaps most importantly, MercExchange challenged the district court’s refusal to issue a permanent injunction against eBay’s use of the invention. The CAFC agreed with MercExchange, that the district court “did not provide any persuasive reason that this case is sufficiently exceptional to justify the denial of a permanent injunction.” Specifically, the CAFC found that the fact that MercExchange expressed a willingness to license was not a valid reason for depriving it of the right to an injunction to which it would otherwise be entitled.

If the injunction gives the patentee additional leverage in licensing, that is a natural consequence of the right to exclude and not an inappropriate reward to a party that does not intend to compete in the marketplace with potential infringers. . . . We therefore see no reason to depart from the general rule that courts will issue permanent injunctions against patent infringement absent exceptional circumstances.

Of course, there is only a very small likelihood that eBay would allow its servers to be shut-down rather than settle the case. In addition, it is unclear how an injunction would operate in this case, although it would most likely only alter e-bay’s ‘buy it now’ feature.

Finally, the appellate panel affirmed the portion of the judgment denying an award of enhanced damages or attorney fees for MercExchange.

AFFIRMED IN PART, REVERSED IN PART, VACATED IN PART, and REMANDED.

The MercExchange patents are also under reexamination at the Patent Office. However, if the litigation concludes before the reexam is complete, there is some question as to whether the reexam can be used by eBay to re-open the case. One issue stems from the 1803 case of Marbury v. Madison where the Supreme Court held that the Judiciary, not the Executive Branch that determined the law. In this case, the PTO (Executive Branch) would be telling the Judiciary to change its mind.

Links:

-

eBay Press Release:

March 16, 2005 04:02 PM US Eastern Timezone

eBay Statement on U.S. Court of Appeals Ruling in MercExchange Case

SAN JOSE, Calif.–(BUSINESS WIRE)–March 16, 2005–eBay (Nasdaq:EBAY) is pleased with today’s decision by the U.S. Court of Appeals that invalidates one of MercExchange’s patents, and as a result, throws out all the related damages. Looking forward, we believe that any injunction that might be issued by the District Court with respect to the other patent will not have an impact on our business because of changes we have made following the District Court’s original verdict. The U.S. Patent and Trademark Office is actively reexamining all of MercExchange’s patents, having found that substantial questions exist regarding the validity of MercExchange’s claims. The Patent and Trademark office has already initially rejected all of the claims of one of MercExchange’s patents. We are confident in our position against MercExchange and do not believe that these matters will have any impact on our business.