by Dennis Crouch

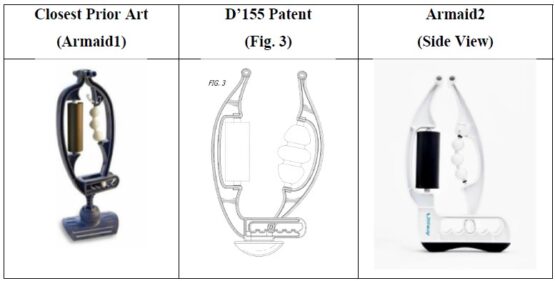

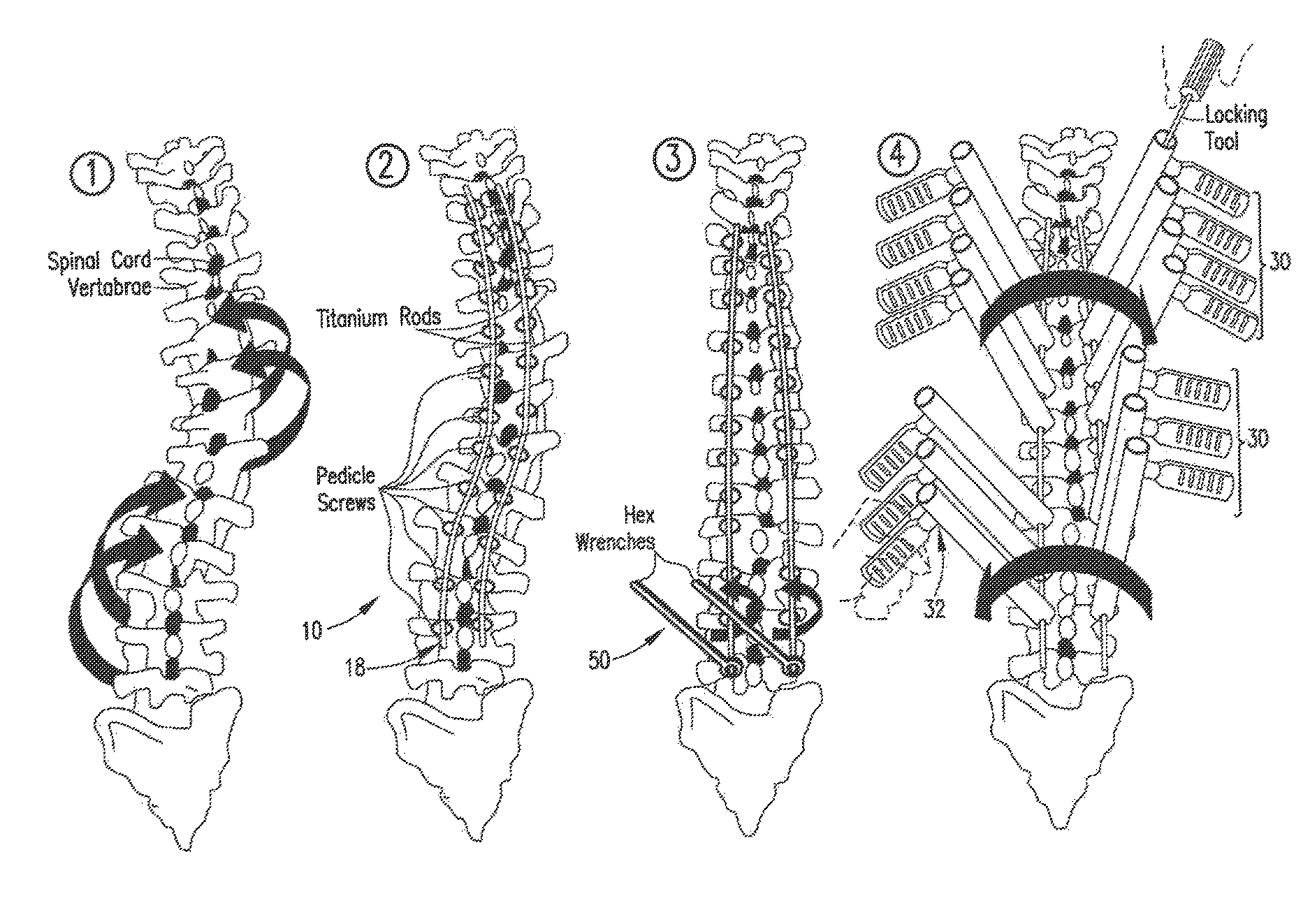

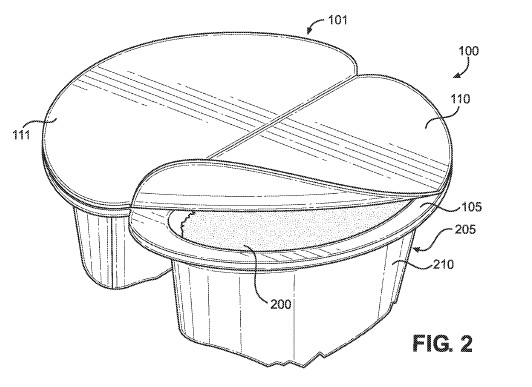

The Federal Circuit's decision in Range of Motion Products, LLC v. Armaid Company Inc., No. 2023-2427 (Fed. Cir. Feb. 2, 2026), affirms summary judgment of non-infringement in a design patent dispute involving body massaging devices. The most important part of the case is Chief Judge Moore's dissent, which offers an attack on how the Federal Circuit has been applying the "plainly dissimilar" standard for design patent infringement. Drawing on psychological research, empirical survey data from recent amicus briefs, and a children's puzzle from Highlights magazine, Chief Judge Moore argues that the court's post-Egyptian Goddess framing has fundamentally shifted the infringement analysis away from the Supreme Court's "substantially similar" test in Gorham Co. v. White, 81 U.S. 511 (1871).

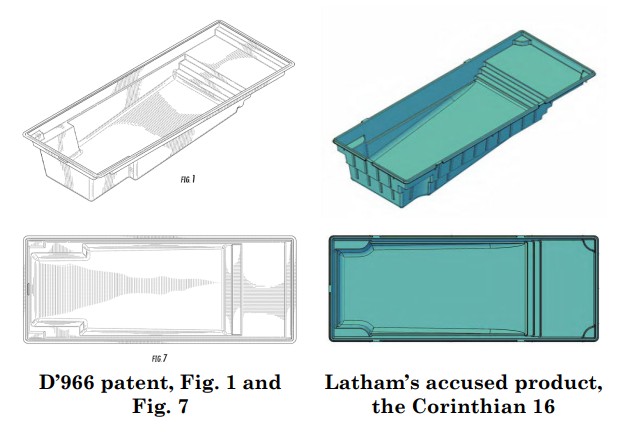

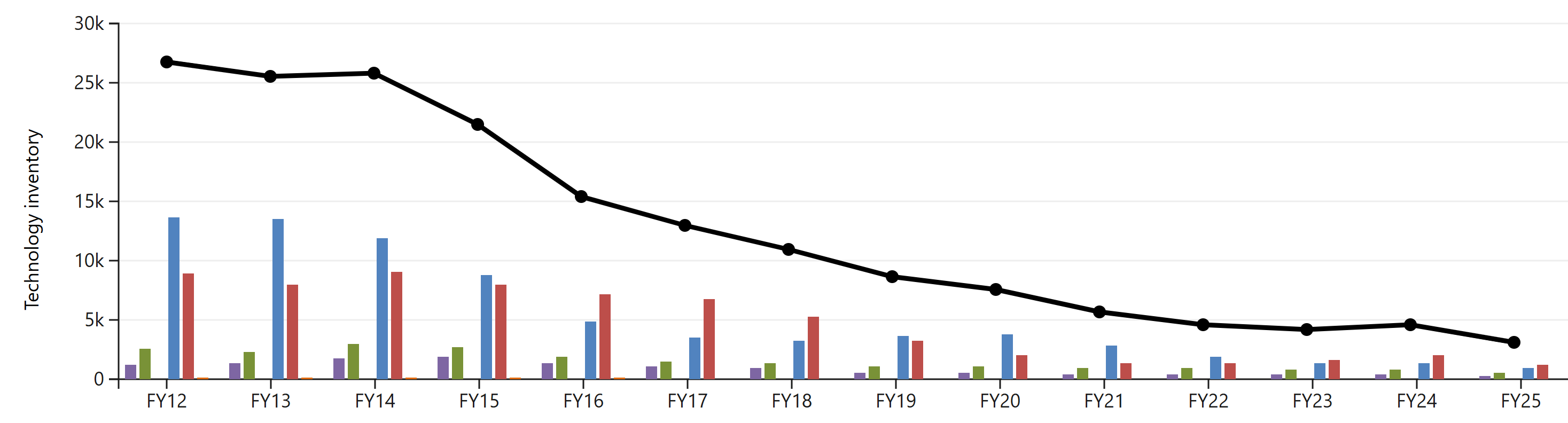

The majority opinion in this case, authored by Judge Cunningham and joined by Judge Hughes, dismisses these concerns in a footnote, setting up what may become a vehicle for Supreme Court review. Note that in September 2025, the Federal Circuit denied en banc rehearing on a similar issue in North Star Technology v. Latham Pool Products, 23-02138 (Fed. Cir. 2025).

The oral arguments included lots of interesting statements including the following:

Judge Hughes: Well, first of all, the problem is you have failed to give a specific claim construction that would allow us to determine what's ornamental and what's not. You just say "the appearance." Well, that's just like your dumb patent ...

Chief Judge Moore: You said that out loud. That was not just in your head.

Judge Hughes: I'm perfectly content saying it out loud. I mean, you look at the front of your blue brief and you say the claim is this picture. Well, sure, that's the way you do design patents, but when you're doing claim construction, we use words and you have to give them words. And just saying "overall appearance" is not words.

Judge Hughes also authored the North Star Tech. opinion. Listening to the North Star Tech oral arguments, I also note Judge Chen's disregard of the patent in that case:

Judge Chen: I mean, we've had rectangular pools since there were pools. We've had rectangular tanning ledges ever since there were tanning ledges. We've had full-width steps from tanning ledges to the other part of the pool since forever. We've had deep-end benches since forever. And so I don't understand what was the contribution. What's the ornamentality here? Because other than what I just identified, this pool design doesn't have anything. It's so elemental. So basic.

To continue reading, become a Patently-O member. Already a member? Simply log in to access the full post.