by Dennis Crouch

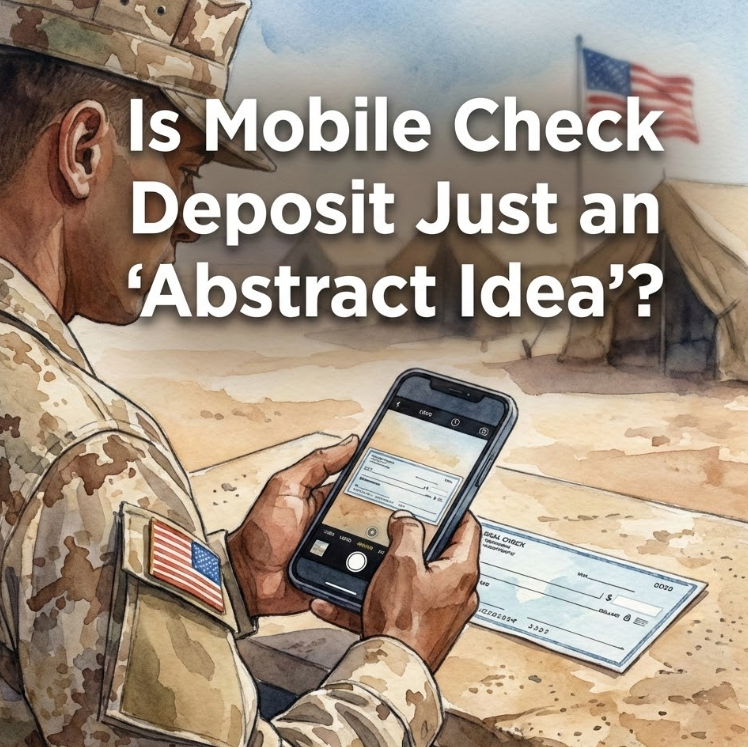

I only recently started using mobile check deposits. I don't get very many checks these days, but when I do it is a real pain to drag myself to the the bank to deposit -- particularly because I don't carry my ATM card with me. Great convenience -- and also a great patent story.

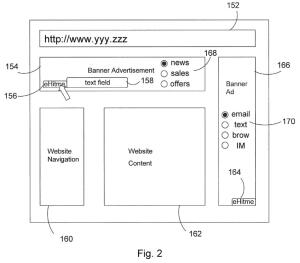

USAA is a financial services association cooperatively owned by U.S. military members, veterans, and their families. Because USAA serves military families whether stationed at home or deployed overseas to places like Iraq and Afghanistan, it does not operate a traditional branch network. This created a persistent problem: how could USAA members deposit checks when stationed far from any bank? Starting around 2005, a team at USAA began researching technology that would allow members to deposit checks from anywhere in the world using devices they already owned. The challenge was formidable: as of the 2006 priority date, the banking industry conventional wisdom was that specialized check-scanning equipment was the only way to reliably capture check images meeting the technical requirements for remote deposit under the Check 21 Act. USAA's engineers developed a system using a downloaded mobile app to assist customers in capturing compliant check images without specialized equipment, launching Deposit@Mobile in 2009 as the first mobile check deposit service offered by any U.S. bank. Within a month, it became the number one financial app in the Apple app store, with members depositing over 1.5 million checks in the first year.

To continue reading, become a Patently-O member. Already a member? Simply log in to access the full post.