The Patent Eligibility Restoration Act (PERA) of 2024: From Oz to Earth

by Dennis Crouch

As its name suggests, the Patent Eligibility Restoration Act (PERA) is designed to substantially overturn the Supreme Court's decisions in Mayo Collaborative Services v. Prometheus Laboratories, Inc., 566 U.S. 66 (2012), and Alice Corp. v. CLS Bank International, 573 U.S. 208 (2014). Together those cases created a firestorm of invalid patents and challenges for the patent office and patent holders alike. The bipartisan proposal was introduced in the Senate (Coons/Tillis) earlier this term and most recently introduced to the US House of Representatives (Kiley/Peters). Although Alice and Mayo doctrine created substantial confusion, much of that confusion has now died down in the past decade.* The bigger issue is that it is substantially harder to obtain patents and easier to invalidate issued patents -- particularly in cases where the invention lies in software or diagnostic methods. This post examines the proposed PERA and its potential impact -- along with providing a bit of data.

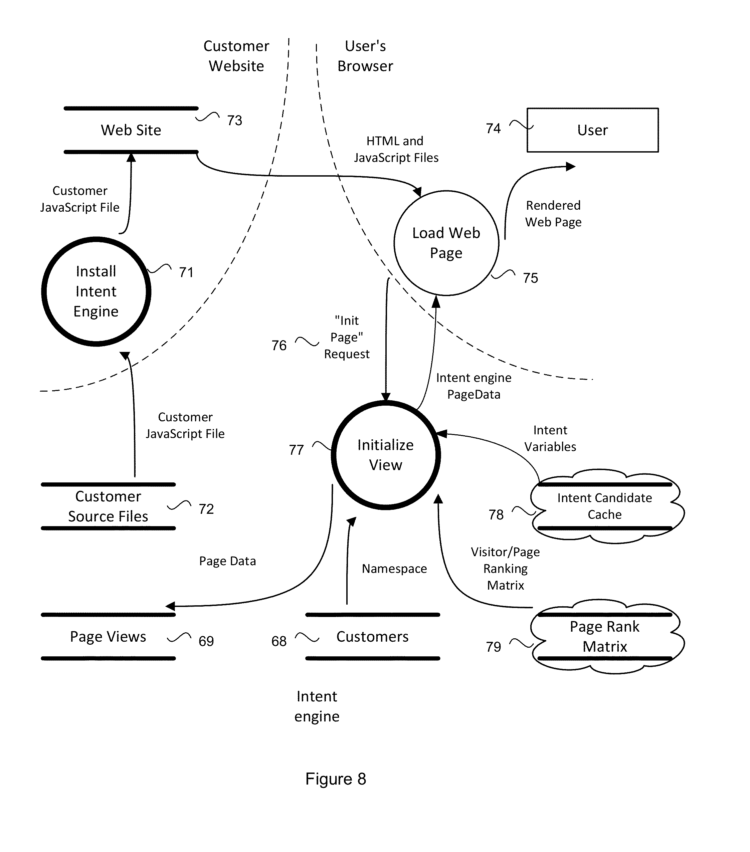

* Although the extreme confusion is gone, there is still plenty to go around. A case in point is the Federal Circuit's September 3, 2024 decision in BBiTV v. Amazon. In that case, the court showed its linguistic flexibility in distinguishing the claimed user interface (deemed ineligible) from those in Core Wireless and Data Engine (deemed eligible).

To continue reading, become a Patently-O member. Already a member? Simply log in to access the full post.