Two Mandamus Petitions: Transfer Granted, Improper Service Denied

Gogo Continues In-Flight Services as Federal Circuit Rejects SmartSky’s Preliminary Injunction Appeal

Race to the Finish: Timing Battles in Parallel IPR and District Court Litigation

Has Diehr been Overruled?; and How do you Prove Technological Advance

Federal Circuit on TM Law’s Information Matter Doctrine

Guest Post by Prof Burstein: Sanctions & Schedule A

By Sarah Burstein, Professor of Law at Suffolk University Law School

The Schedule A litigation phenomenon continues apace in the Northern District of Illinois, a court that has become, in the words of Judge Seeger, “an assembly line for TROs.” But Schedule A litigation is not confined to Chicago. It has spread, perhaps most notably to the Southern District of Florida and the Southern District of New York.

One recent decision out of New York merits closer attention. In this case, as in most Schedule A cases, the plaintiff was able to obtain an ex parte TRO that included an order instructing Amazon to freeze the defendants’ seller accounts. The order also required the plaintiff to post a bond of $20,000 “for the payment of any damages any person may be entitled to recover as a result of an improper or wrongful restraint ordered.”

The plaintiff sued 163 defendants, alleging that each was liable for infringing a utility patent directed towards “a rectangular-shaped buckle-and-belt mechanism” for “an outdoor exercise product.”

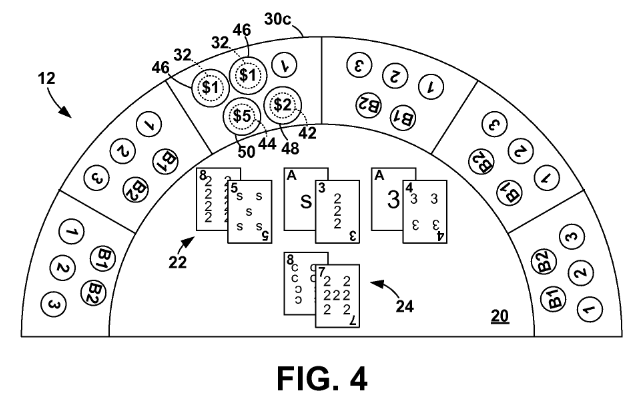

At the TRO stage, the plaintiff’s “infringement evidence chart” consisted of a series of screenshots (many of them low-resolution screenshots) of the accused products. Here’s an example of all of the evidence submitted in that chart with respect to one of the defendants:

Two of the defendants, Hyponix and NinjaSafe, moved for bond damages, sanctions, and fees. They argued that the plaintiff had filed to conduct a sufficient pre-suit investigation and had committed various acts of litigation misconduct. They further argued that they each suffered damages from being wrongfully enjoined.

Judge Rochon granted the defendants’ motions for bond damages but denied their motions for sanctions and fees. She agreed that the moving defendants had been wrongfully enjoined because “Hyponix has pointed to at least four elements of claim 1 of the ’673 patent that are not present in its product” and “Ninja Safe has also shown that its products may not infringe claim 1 and has raised questions of invalidity.” Accordingly, Judge Rochon granted each moving defendant bond damages, though less than they asked for: $3,682.28 for Hyponix and $14,641.51 for NinjaSafe.

But she refused to grant sanctions or fees, despite being “troubled by Plaintiff’s conduct in this case.” In particular, Judge Rochon noted the “‘clear discrepancies’ between the protected elements of the ’673 Patent and the products of many of the parties against which Plaintiff secured a TRO.” She also noted other instances of “possible misconduct,” including:

- “Plaintiff represented that most of the 163 parties were difficult to find and contact. In practice, however, contact information for many of the parties was readily available. . . . Plaintiff does not indicate that it tried with any diligence to locate these parties before seeking a TRO.”

- “The pace and prevalence of Plaintiff’s dismissals suggest to the Court that Plaintiff used Rule 41 as part of a broader strategy to freeze the accounts of its competitors, then withdraw its claim against any party that happened to object.”

- “Plaintiff failed to provide Hyponix with documents necessary for its defense. . . . . Plaintiff claims, falsely, that Hyponix did not request these documents.”

(Emphasis added.) Despite all of this, Judge Rochon refused to sanction the plaintiff:

Despite these concerns, the Court does not lightly award sanctions and will not do so in this case. Plaintiff holds a valid patent for its Hanging Exercise Product, its claim was colorable against at least some of the parties, and it dismissed its lawsuit voluntarily at a very early stage in the litigation (presumably in light of the issues raised by the Court at the order to show cause hearing), before any of the defendants responded to the Amended Complaint. Defendants here were made whole for their losses under the bond. Although a close question, the Court exercises its discretion to deny Defendants’ request for sanctions under its inherent powers and 28 U.S.C. § 1927. . . . To the extent that Plaintiff and its counsel engage in similar misconduct in the future, however, the Court will not hesitate to impose sanctions.

As Professor Eric Goldman noted in this blog post, “it would not be lightly awarding sanction when a plaintiff has committed so many violations.” Two additional points stand out as well.

First, the fact that some of the infringement claims might be colorable does not change the fact that the plaintiff brought numerous claims that were not—including the claims brought against the moving defendants. If the plaintiff had sued Hyponix and NinjaSafe separately, would that have changed the court’s analysis? If so, why should the fact of mass joinder insulate the plaintiff from sanctions? Especially in light of the fact that it’s far from clear that any—let alone all—of the defendants were properly joined, as they sell different products and do not seem to be actually connected in any way. See 35 U.S.C. § 299. In any case, the fact remains that this plaintiff brought many claims that were not colorable and used the machinery of the federal judiciary to wrongfully enjoin competitors. That is what should matter in the sanctions calculus, not the fact that some of the other claims (against apparently unrelated defendants) might have potentially had merit.

Second, it is true that the plaintiff dismissed the case at what would be, in a regular case, “a very early stage in the litigation.” But in a Schedule A case, the TRO seems to be the whole game. The plaintiff gets a TRO with an asset freeze, then starts making settlement demands. At that point, the defendants generally either settle or default. It appears that these cases aren’t meant to proceed any further. And as the defendants’ submissions show, significant damage can be done in these cases, even in a short period of time. (One also wonders how much money the plaintiff may have been able to extract in settlements before dismissing the case.)

In the end, the decision to sanction and to award fees is left to the discretion of the judge. And while it is encouraging to see Judge Rochon recognize the damage caused by acts that have become common in Schedule A cases (e.g., using FRCP 41 to dismiss defendants who fight back), it is discouraging to see a result that will only serve to further disincentivize Schedule A defendants from fighting back.

Once a judge grants a TRO with an asset freeze, the deck is heavily stacked against the Schedule A defendants. Defendants have strong incentives to settle, even when the cases against them lack merit. In many cases, it’s just too expensive to fight back, especially when your assets have been frozen.

If judges were willing to sanction plaintiffs—or at least shift fees—when Schedule A defendants were wrongfully restrained, that would do a lot to help level the playing field and incentivize the plaintiffs to bring better claims.

Without fee shifting or sanctions, the cost of bringing a nonmeritorious claim in a Schedule A case is virtually zero, while the harms to defendants who are wrongfully restrained—even for a short time—can be devastating. As Judge Hunt has noted, “the extraordinary remedy of freezing all [the defendants’] assets without notice” can “potentially ruin[] a legitimate business.”

Plus, as Casey Hewitt noted on Mastodon, Schedule A “defendants have no choice but to litigate, have no option to meet and confer and avoid a lawsuit . . . They did not ignore demand letters or refuse to negotiate or discuss alleged infringement.” But once they find out that their assets have been frozen, they have to “hire expensive IP litigators or they will lose their businesses.” In these circumstances, it seems like fee shifting for wrongfully enjoined Schedule A defendants should be the norm, not the exception.

Yes, it’s true that a presumption in favor of fee shifting would be a departure from normal federal court practice. But courts routinely use their discretion to grant procedural departures to Schedule A plaintiffs—e.g., email service, ex parte asset freezes, mass joinder upon conclusory (and in many cases, dubious) allegations. Perhaps it is time for judges to start using their discretion to make routine departures for Schedule A defendants, too.

Additional observations:

- This case is a good example of why patent litigation is a poor fit for the Schedule A litigation model. I’ve written here before about how design patent infringement is ill-suited to ex parte adjudication; so too is utility patent adjudication. If judges are going to keep allowing the Schedule A model in patent cases (and they don’t have to do so, in these cases or in any others), they should consider making it a regular practice to special masters to help analyze the infringement evidence at the TRO stage. And they should, at a minimum, require an individualized claim chart for each and every defendant.

- It is far from clear that Judge Rochon actually had the power to freeze these defendants’ assets in the first place. As Judge Kendall noted in a recent order, 35 U.S.C. § 284 “does not provide for the equitable relief of accounting and profits,” which is seems to be the standard basis for asset freezes in other types of IP cases. Furthermore, as Judge Seeger has noted, “Schedule A plaintiffs typically don’t request and receive equitable monetary relief” at the end of their cases, even when equitable relief is available. Other judges might be well-advised to start questioning whether they should use their discretion to keep granting these types of asset freezes, even in cases where a remedy of equitable disgorgement is actually available.

For more on the Schedule A phenomenon, see:

- This essay (by Professor Eric Goldman)

- Section II(B) of this draft article (by me)